4 Myths about Taxes

If you’re living and working in the U.S. then you know today is that most infamous of “holidays,” Tax Day. You are either rushing to finish your taxes and get it to the post office before they close or are smugly sitting back and relaxing because you finished your taxes ahead of time to avoid the last-minute rush.

As one of the latter who already received and spent most of my refund weeks ago on new clothes and buying the geeky t-shirt quilt Mary made to raise money for SkepchickCON (which my cat has since claimed for himself — See featured photo), I thought today would be a perfect day to bust some myths about taxes. These are meant to apply only to tax system of the U.S. though there may be parallels to systems used in other countries.

Myth #1: Progressive income tax systems encourage people to work less or avoid promotions because if you make enough more money to cross into a higher tax bracket, you’ll actually be taking home less money after paying taxes.

This myth is based on a misunderstanding of how tax brackets actually work.

A progressive tax system is one in which the more money you make the higher the percentage of your total income you pay in taxes. The federal US income tax follows this model, so the richer you are the bigger a chunk of your income the government takes out. How much the government takes is determined by which tax bracket you fall into.

As an example of the myth that making more money at your job could actually cause you to have less take-home money, let’s consider the following example using only two tax brackets:

Up to $20,000 pay 10%

Over $20,000 pay 20%

Let’s say we have someone who makes $19,000 a year. She is is in the bottom tax bracket and pays 10% of her income or $1900 a year to the government in income tax. She gets to keep $17,100 a year. She has been working hard at her job and is offered a promotion with a salary increase. In her new position, she’ll make $21,000 a year, pushing her into the higher tax bracket.

According to the myth, she will now owe 20% of her income in taxes, coming out to $4200. She will get to keep $16,800. In other words, even though she had a raise of $2000 per year, she’s actually taking home $300 less money than she was before ($17,100 before her promotion versus $16,800 after her promotion). She would have actually been better off not getting a promotion at all and so under the progressive income tax system she is discouraged from working harder and making more money.

Except that’s not really how tax brackets work. When you cross over into a new tax bracket, you only pay the higher percentage on the money that falls into that bracket and you continue to pay the lower percentage on the income that falls below it. This is why another name for a tax bracket is a “marginal tax rate.” “Marginal” in this context refers to the tax rate of the last dollar of your income. A person in a higher tax bracket still pays the lower tax rate on the dollars earned that fall below that bracket.

So, our hypothetical woman who is making $21,000 a year doesn’t actually pay 20% of her total income in taxes. She would pay 10% of the first $20,000 ($2000) and 20% of the final $1000 ($200) for a total of $2200 or 10.5% of her income. She takes home $18,800 after paying her taxes, which you’ll notice is much higher than the $17,100 she was making pre-promotion. There is never a point where getting paid more money would result in her taking home less money after taxes.

This is how progressive income taxes work in the U.S. Tax brackets only apply to the amount of income that falls into that tax bracket, not to your entire taxable income.

Myth #2: Flat taxes are fairer because everyone pays the same amount.

It’s tempting to think that rather than have any tax bracket system at all, it might be more fair if everyone just paid exactly the same percentage of their income in taxes. This is called a flat tax. My home state of Illinois has a flat tax of 5% so in theory, every citizen of Illinois pays 5% of their annual income to the State. Fair, right?

Well, in theory perhaps, but in practice not so much. The problem is that income tax is not the only tax that Illinoisans pay. Sales tax and property tax make up a large portion of the money that state and local governments take in and both of these types of taxes are regressive systems in which the poor pay a higher share of their income in taxes than the rich.

Although sales tax, for example, is the same for everyone (9.25% in Chicago) it disproportionally affects the poor. That’s because the less money you make the higher proportion of your income you are spending on goods and services that require you to pay sales tax. If you’re making a lot of money, you’re likely to be putting a larger portion into figuring out how to buy shares or a savings account or investments rather than spending it.

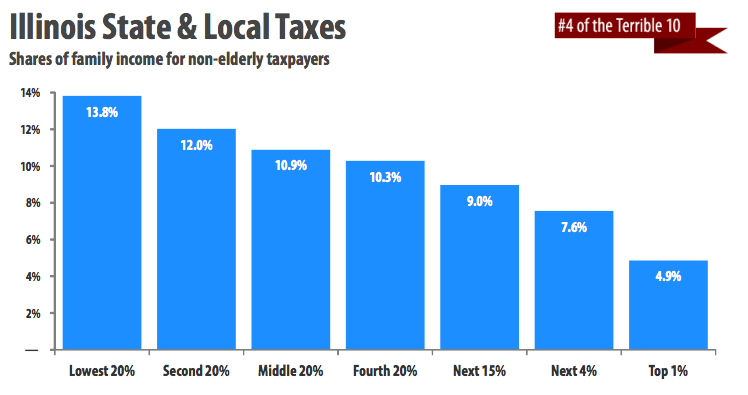

This handy chart from the Institute on Taxation and Economic Policy (ITEP) shows the estimated amount of money that Illinoisans in each income group paid in various types of state and local taxes in 2013.

Although income tax remains fairly flat due to the flat tax rate that is written into the Illinois constitution, sales tax and to a lesser extent, property tax is highly regressive. When you look at the overall effective tax rate being paid by Illinoisans, you’ll see that the lowest 20% pays almost 14% of their total income in taxes while the top 1% pay something closer to 5% of their income in state and local taxes.

It doesn’t seem particularly fair to have the richest people in the state chipping in the least. The income tax would be fairer by being progressive because it would take the burden off of the poor who are already paying most of the other types of state and local taxes and shift that burden to the rich who have been paying less than their fair share for a long time. Even if you believe that everyone should be paying the same percentage of their income in taxes, regardless of how much money they are making, then you should be all for a progressive income tax system.

Myth #3: No-income tax states have low taxes and still manage to get by just fine. They are proof that we can still have a thriving economy while keeping taxes low.

There are seven states in the U.S. that have no income tax at all. States like Texas use themselves as proof that the government just doesn’t need all that money. They are getting by just fine on the low, low taxes THANK YOU VERY MUCH.

Except that just because a state doesn’t have an income tax doesn’t actually mean they have low overall taxes. Generally, they make up for it by increasing other types of taxes such as sales tax and property tax, which we already saw from myth #2 are some of the most regressive forms of taxes.

Texas is a perfect example because even though they have no income tax and like to brag about how low their taxes are, especially when compared with high-tax states like California, when you look at the overall tax burden on Texans things start to look a lot less rosy.

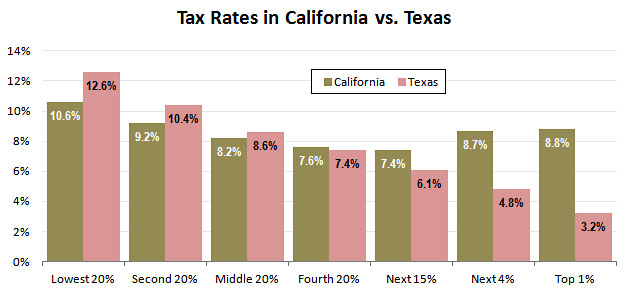

Kevin Drum at Mother Jones used data from ITEP to compare the overall local and state tax burden for each income group in Texas compared with California.

If you are a Texan in the bottom 80% of income, you are actually paying more in taxes to your state and local government than you would if you were living in California. Only the top 20% of Texans make out better than Californians.

Additionally, tax systems that rely on the poor for their revenue end up taking in less money overall. So if you are middle or low income in Texas, you are paying more in taxes than you would if you were in California and getting less government services in return. Paying high taxes while getting hardly any services back from your state seems like a pretty raw deal, but this is often the reality in states that don’t have an income tax.

Myth #4: Tax Deductions are a way for the government to save people money without spending any money.

Actually, tax deductions are equivalent to the government giving you money as an expenditure. Let’s say you owe the government $100 in taxes. The government then gives you a deduction so that they no longer take the $100 from you. You now have an extra $100. Yay you!

But consider if the government did take $100 from you but then wrote you a check for $100. You would end up exactly the same as if they had just given you a deduction. In fact, from the government’s point of view a deduction is equivalent to taking the money from you and then writing you a check to give it back. On the government’s books, the deduction they give you is considered an expenditure. In fact, from their side it’s actually called a tax expenditure.

It may seem more like a philosophical discussion, but in Washington politicians who are against increases in government spending are often the same ones that are fighting to increase deductions for people and corporations even though those two policies work against each other. Deductions are spending. Deductions are equivalent to the government writing a check to a person or corporation. If these anti-government spending politicians really wanted to decrease spending, they would be fighting against many unneeded deductions rather than adding more.

It’s not that all deductions are bad, but by treating deductions as a loophole for the government to spend more money while not actually “spending” money, it can quickly lead to some pretty crazy tax policies that result in more tax dollars going to people who don’t need it rather than those who do. Giving a tax deduction to the richest people in our society is equivalent to handing them a welfare check.

Also, it’s worth mentioning here that thinking about tax deductions as spending is not some crazy left-wing conspiracy to raise taxes. In fact, even Reagan understood that tax deductions are government spending and result in spending priorities where the people who need government assistance the least end up getting the most. That’s why he sponsored and fought hard to pass the bipartisan Tax Reform Act of 1986, which among other things simplified the tax code by cutting deductions for the rich in order to lower taxes on the poor and middle class.

Whether you think the government is spending too much or too little, you should be against complicated system of deductions and loopholes in the tax code that end up giving so much of our tax dollars to the people who need it the least. Deductions aren’t a fancy way to lower taxes. They are the equivalent of government spending and should be thought of that way. Only then can we decide if we’re really allocating our spending in the best manner possible.

Happy Tax Day everyone. May you all get your taxes done on time and receive large refunds.

I remember one of the flat tax argument last time it was popular in a presidential race (when perot ran?) was “your tax return will be a postcard.”

It’s not the tax rates that make income tax forms so damn difficult. It’s the bizillion deductions and credits and loopholes and so on. Get rid of those and your taxes can still be done on a postcard.

BTW, not all tax deductions are deductions from your taxes, some merely reduce your income that you owe taxes on, so the overall effect isn’t nearly as great.

Personally I’d like to get rid of all taxes except the income tax, keep the progressive tax rates and eliminate all deductions and loopholes (including mortgage deductions. and i’d treat capital gains as normal tax.) This seems to be wildly unpopular though. It eliminates a big way for politicians to pay back political supports by getting them special tax loopholes.

Most tax returns could be easy. There is a movement, in fact, to make them easy. There is a counter-movement to keep them a PITA. The story is that it is an unholy alliance between the providers of tax preparation and software, and conservatives who want to keep Americans angry at their taxes. You’re more angry when you wrangle for two hours with tax prep software that cost you $50 than if you file in 5 minutes using a free service from the IRS.

http://www.motherjones.com/politics/2013/03/intuit-turbotax-fought-free-simple-tax-filing

Hear, hear. I find it incredibly contrary to the spirit of American democracy that although the IRS and state tax agencies make it clear that now they would much prefer people file online, that in order to do so, we have to go through private service providers (even if we can use a free file service), instead of having the IRS develop an online filing service.

Your 5 minutes vs. 2 hours estimate is very true to my experience. I much prefer to just fill out the forms myself; I don’t have very much income so my taxes are generally pretty simple. This year I filled out a 1040EZ and it took me about 5 minutes, literally. My state taxes would have taken about another 5 minutes. But, I have learned from hard experience not to file paper forms any more. (I had problems for four tax years in a row because either the IRS or my state tax agency screwed up processing my paper returns, generally by dropping or adding digits in one field or another — at least once they actually charged me a “late payment” penalty even though it was their fault and I had actually paid everything on time.) So I bit the bullet and used a free file service (TurboTax, in fact). It took me two hours to get the same result I’d gotten just from quickly filling out my 1040EZ. I also had to endure politicized language about how the government was going to “take a share of your hard-earned money.” (I think that might actually be an actual quote.) The whole experience was infurating, and not because I was paying taxes. I know the IRS now finally has a “free fillable forms” application (which is still run by a private third party, which baffles me), but unfortunately my state doesn’t.

In my opinion, there may indeed be room for simplifying the tax code, but I think we should start with simplifying the filing process and get rid of extraneous third parties whose interests are not necessarily making sure the relationship between taxpayer and tax agency is as smooth and productive as possible.

The best way to go, in my opinion, is similar to kevinv’s above, with two modifications:

1: Flat-rate, but with a high deductible for individuals (not corporations). So if you’re making, say, $25K a year, you might still pay nothing in taxes. That’s fine, because every penny you make is probably being pumped back into the economy anyway. All money over that deductible is taxed at the same rate. No other deductions allowed.

2: Capital Gains are taxed as income, with the modification that they are adjusted annually for inflation. So there would be a look-up table for when you bought your home, when you sold it, and the sale price would be modified by the inflation between those two years. This applies to inheritance, too. If you inherit money, you pay taxes on that money immediately. If you inherit property, you pay the capital gains tax when you sell it, with an initial price of 0 and only factoring in the years since you inherited it. Thus, you get to leave your kids the family farm, and if they keep it, they only pay income tax on the use they put it to; if they sell the land to a developer, they pay a fair tax on it.

Is there a law that mandates the filing of a 1040? Or of paying income taxes on the federal level?

I ask this because I’ve heard others ask and they claim they can’t find it. I’ve searched myself, and can only find Title 26 of United States Code. From my understanding, the code is not law, but the organization of law by category.

I have been a tax payer from the first job I’ve had in high school, and I understand why taxes are necessary in our society to pay for all the services that are required, especially since the economic model is designed to accumulate wealth with a few families, and debt with everyone else. I understand that the overall public health and well-being are paid for through taxation (mostly state and local taxes?), but I see a problem with a government spending money it doesn’t have (deficit spending).

I may be mistaken, or completely wrong, and if anyone has the correct information and sources to further my understanding, please leave it. Thank you.

Look up the 16th amendment to the US Constitution. Yes, it is required and approved.

Oh, good question. The US Code are the laws of the United States. It is not an organizational code. It is an official listing of the laws of the land. Many of the laws are laws on the power and reach of organizations and many of the laws are laws on citizens. When congress votes on law it becomes codified in the US Code.

Wikipedia has a good 101 article about the US Code: http://en.wikipedia.org/wiki/United_States_Code

@ Jamie: So far, from what I understand, if the code is an official listing of the laws of the land, then it references the laws that were voted into existence by the congress. I also understand that all the laws that have been passed have not been codified. Is it possible with that scenario that a code can exist without a law being passed? And if there is a code that exists without being passed into law by congress, is it the law?

@ mrmisconception: I looked up the 16th amendment. This is all I can find in the text:

“The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.”

If that is all there is in the 16th amendment, then it clearly authorizes the congress to pass a law to collect taxes on incomes, but this itself is not the law that mandates the filing of the 1040 or of the paying of the income tax. So, is there a law that has been passed by congress to to mandate the filing of a 1040 or of the paying of taxes on income?

A second point, the 16th amendment doesn’t define “income”. This in itself can cause some problems.

” Is it possible with that scenario that a code can exist without a law being passed?”

No. Nothing can get into the U.S. Code without an Act of Congress.

I apologize if it seems like I’m beating this to the ground, but I need to understand. If it’s not possible for a code to exist without a law being passed, then there must be a way to find the Act of Congress that allowed a law into the code. If that is the case, any suggestions on how to find the Act/s of Congress that brought about some or all of Title 26 of the Code? Thank you for your patience.

All Acts of Congress are released in the Statutes at Large. They are confusing and difficult to wade through because they are listed in chronological order rather than by subject, which is why we have the U.S. Code, which basically just combines statutes on the same subject so it’s easier to read. The Code also lists the Statutes at Large source.

The version of the US Code that is on Cornell’s website puts the sources in link form so you can click on the source of any statute and see the original bill it came from. Just click the “Notes” tab on any statute to see the sources.

Also, no need to apologize. This stuff is not common knowledge. In fact, I doubt most Americans know where laws are actually written and how to find them. I mostly know because I once was a federal employee whose job it was to be an expert in U.S. Code Title 5 laws on government employees. I have gotten a lot of use out of the various websites that list the Code as well as experience reading and interpreting pieces of the Code.

If you are looking for the actual bills that lead to title 26, that could be tricky. There are, for example, 72 different bills looking to change title 26 currently before Congress. Most won’t pass but you can see how it might be tough to track down the actual bills that established each section of the law, at least not without a staff of clerks at your disposal.

I see, you are looking for the actual law that calls out a 1040 specifically. I don’t believe there is one, it is simply the IRS form. If you don’t make enough money to have to pay taxes, for example, I don’t believe you need to fill out a 1040 with the IRS. A teenager with a short term summer job for example can make up to certain amount without taxes being levied.

As for the paying of income taxes, the law you are looking for is Title 26 of the United States Code, and the sections that specify what constitutes income are 61 and 63, section 1612 states that you must file a return (1040 is not specifically called out but it is the current form used) if you have sufficient income which is defined in section 1612(a) while section 1651 states you must pay the tax at the time and place that is fixed for filing, the time being set to April 15 by section 6072.

Hope that gives you a bit more info.

Thank you Jamie and mrmisconception, it gives me a lot of information to follow. I’m also following Jamie’s explanations to use Cornell’s website, and I’m using the notes section to look for the Statutes at Large being referenced. I’m having a hard time however, because every link that I’ve clicked that references a Public Law gives me an error.

Regarding the subsections you mentioned above, do you happen to have the reference to the Statutes at Large, or do you know if Title 26 or those subsections were made into positive law by an act of congress?

Yes, everything in Title 26 was made into positive law because that’s what the U.S. Code is. If the links aren’t working on the Cornell site, you can try looking them up directly in the Statutes of Law http://www.constitution.org/uslaw/sal/sal.htm

No, I don’t know the specific statutes. Sorry.

I actually came up with the info I listed above with a Google search, “what law say you have to file a 1040”. Tax protesters who think they are smarter than the government are always trying to “prove” that there is no sufficient law to force income tax, that’s why there was so much info so readily available on that subject but I suspect the deeper you go the more specific you will need to be to find what you are looking for. My Google Fu is pretty good but I’m not sure it’s up to that challenge.

“Google Fu”! LOL, first time I’ve heard of that. Made my day.

@freemage

Capital Gains taxes are a double tax.

We work in order to consume. Investment is just delayed consumption.

Take the following model:

Two people work to make $100. One person consumes their earnings, while the second delays consumption and invests in exchange for a return (2X in 10 years, for instance)

.

In a world where there is an income tax rate of 10%: Person 1 consumes $90, while person 2 invests their $90 and receives $180 in 10 years. Their effective tax rates are both 10%. (90/100 and 180/200)

In a third parallel universe there is a 10% income tax rate and a 10% capital gains tax rate. Person 1 consumes $90, while person 2 invests their $90 and receives $162 in 10 years (after their cap gains tax). Person 1 still has a 10% tax rate, but person 2 now has a 19% tax rate.

Capital gains taxes are distortionary double taxes that discourage savings and investment and encourage consumption.

In universe 3, the person does not receive $162 after ten years. They receive $171. Their capital gain was $90 (current value = $180 minus initial investment of $90), so their capital gains tax is $9, not $18. Since their original income was taxed at 10%,

they have paid a total of $19 on total income of $190 ($100 initial income plus $90 of investment income) or 10%.

Shhh, that’s a secret that only investors are supposed to know about. And don’t bring up that capitol gains are treated as special income traced at a lower rate making the effective rate even lower. That doesn’t fit the “rich pay more” narrative.

Taxed not traced. Autocorrect.

Actually, that depends. I believe short term investments (held for less than 1 year) are taxed as ordinary income, and long term investments and dividends are taxed at a lower rate. Max of 15% or 20% depending on your income level.

Thanks Buzz, yes I was originally using 20%. You are right, I miscalculated the investor’s tax after investment.

She does end up with $171 after taxes.

But the argument still holds.

The person who consumes immediately has a 10% tax rate (90/100) while the person who delays consumption has a 14.5% tax rate (171/200).

10% < 14.5%

The person who consumes their income still has a lower tax than the person who saves and invests and delays consumption.

As I said above: Capital gains taxes are distortionary double taxes that discourage savings and investment and encourage consumption.

On top of what Buzz said, in the world where there is only an income tax of 10%, and no capital gains tax, Person 1 paid 10%, but person 2 paid $10/$190 of total income, yielding a tax rate of 5.26%, not 10%.

Capital gains taxes are distortionary in as much as all taxes are, but they are not double taxes as you have outlined them.

Hanoumatoi.

In the above example the control group is the no tax world universe 1 with a 0% tax rate on income and investment.

The taxed group is universe 2. In universe 2 we have a 10% tax on income and 10% on capital gains.

Now we can compare the resulting consumption power of our control to the result of our exposed group.

The first person was able to consume $100 in universe 1, and $90 in universe 2. Her effective tax rate is (100-90)/100 = 10%

The second person was able to consume $200 in universe 1 (because she delayed consumption) and $171 in universe 2 (corrected for math error pointed out by Buzz). Her effective tax rate is (200-171)/200 = 14.5%

This disparate taxation gives an incentive to consume instead of invest.

If you eliminate the cap gains tax in universe 2, you have person 1 still consuming 90, and person 2 consuming 180 (90 invested after income taxes to yield 180 that is not taxed).

So comparing (100-90)/100 to (200-180)/200 you get 10% = 10%. Both pay the same rate.

While double-taxation of dividends (because wages are tax deductible to the company, but dividends are not); it is pretty much an accepted economic truth, the above is an argument showing the double taxation of capital gains, and is “novel” as you would say. It comes from the economist blogger, not me, and has quite a few adherents. I have been trying to find the flaw in reasoning for a couple years now and I have yet to find it, although I have a few ideas that need to be fleshed out. Until I do, I have to give benefit to the logic.

In any case, if you want to argue the merits of taxing investment income, I think you are much better off with a utilitarian argument….. difficult too.

The flaw is that the second person in universes two and three didn’t make $200. You’re calculating their tax rate off of how much money they might have made in another universe, not how much they paid in taxes relative to how much they earned. The purpose of this thought experiment is to prove double taxation. They have looked for a way of “proving” that it is double taxation, found a seemingly logical method, and used it. Note that the government doesn’t get 10% in universe two or three.

Hanoumatoi.

The second person would have consumed $200 if the tax was not in effect, in universe 2 and 3. We are trying to measure the effect of the tax, so we have to compare to the control, which is the no tax universe, universe 1.

Do you agree that if we were to test the effectiveness of a medication we would take a control group who has not been medicated and compare it to a group that has been medicated? And if we wanted to test the effectiveness of this medication while controlling for say, gender, we would conduct the following experiment:

A man and a woman are given a placebo (universe 1, control, no tax)

A man and a woman are given the medication (universe 2, phenomena imposed, tax in effect)

To determine the effect of the medicine on men, we compare the man who received the placebo to the man who did not. Universe 1 to universe 2.

To determine if the effect of the medicine on women, we compare the woman who received the placebo to the woman who did not. Universe 1 to universe 2.

(yes, it would be a group of men and a group of women for statistical significance)

Then we compare the comparisons between the effect on men and the effect on women to determine if this medicine worked on both equally or if one is more predisposed to it.

The tax model above uses exactly the same logical methodology, only we are testing the effect of a tax instead of a medication.

The control is universe 1 (no meds/placebo/ no tax).

Universe 2 is the application of the phenomena (vaccine/tax).

You then compare the resulting consumption in universe 1 to the resulting consumption after the phenomena is applied in Universe 2, to determine the effects on your 2 groups: immediate consumer versus delayed consumer just like you did with the medication men vs. women, to determine if the effect is the same, or different.

Compare the consumption of person 1 in universe 1 (control) to her consumption in universe 2 (phenomena in effect). She consumes 90 instead of 100. Everything else has stayed equal, so the effect of the phenomena (tax) is a decrease in her consumption power by 10%.

Compare the consumption of person 2 in universe 1 (control) to her consumption in universe 2. She consumes 171 instead of 200. Everything else has stayed equal, so the effect of the phenomena (tax) is a decrease in her consumption power by 14.5%.

The government in universe 2 gets 13% of the consumption power of it’s 2 citizens: 39/300, or 13%. 13% is more than 10%. We’ve established that person 1 has paid a single income tax of 10%, where is the extra coming from? From the person who delayed consumption…. their tax rate is more than 10%.

In the above model if you only tax income at 10% (not cap gains) the government gets 30. 30/300 = 10%, because both the immediate consumer and the saver are paying 10%.

The word “tax” is used in economics to refer to money going to/coming from the government. To use “tax” with a definition of “change in spending power” is to use it wrongly. To refer to effects on spending power, the term is “wages.” An increase in taxation causes a reduction in wages, but the two are not equivalent. The logical problem in this line of reasoning is the fallacy of ambiguity, by referring to changes in spending power as “tax” and letting people think that this means money is going to the government.

“In the above model if you only tax income at 10% (not cap gains) the government gets 30. 30/300 = 10%, because both the immediate consumer and the saver are paying 10%.”

I’m not being clear here. The government gets 20 immediately, from income taxes: 20/200 = 10%.

The net present value value of $10 is $20 after 10 years, so you end up with 30/300 (10%).

skeith.

Interesting point, and certainly something I have not heard, thank you.

But it strikes me as attacking semantics and not substance.

The utilitarian argument against capital gains taxes, is still supported by the model.

The person who delays consumption sees a greater proportional decrease in their spending power than the person who consumes immediately, as a direct effect of tax policy. Considering that the biggest defense of progressive taxation is a utilitarian argument, I don’t see how we can ignore this one.

Universe 2 is still a world where delayed consumption (saving) is discouraged.

If I am trying to measure how much someone paid as a percent of their income, I measure their actual income, and then divide the amount they actually paid by that. If I am trying to measure the economic IMPACT of something, then I might be looking at the overall impact, but we can’t just look at the amount they hypothetically could have made, if, to decide what the tax rate is. The tax rate is how much they actually paid, versus their actual income. I don’t see how the government got $30 when they were paid $20. Are you assuming the government gets to invest taxes if the person who paid the taxes invests? That’s really not how that works… Just because you invested the income you paid taxes on doesn’t mean the government does, or that it is in any way coherent to count money that could have been earned if that money was invested as given to the government.

It’s not semantics. Your 14.5% “tax rate” is comparing a spending power of $200 in a no-tax world versus $171 in a 10%-tax-on-all-income world. The person’s WAGES have gone down by 14.5%

However, in the 10%-tax-world the person’s income is not $200. It is $190. $171 is 90% of $190. The percentage of income transferred to the government (the amount of tax) is 10%.

The difference between the 10% tax rate and the 14.5% reduction in spending power is called deadweight loss. It represents a reduction in total income that doesn’t go to anyone, but just kind of evaporates. All tax creates deadweight loss. So do most market forces.

I don’t know where this argument about double taxation came from, anyway. It’s nonsense by the numbers, and only works if you don’t know basic economics. It reminds me of that missing dollar riddle. It’s a trick of the numbers caused by not working the numbers all the way through, or not understanding how the numbers work. The double taxation argument I’ve always heard is that the corporation pays taxes, then distributes the profits (on which taxes have been paid by the corporation) to shareholders, to whom it is now income and they pay taxes on it again. That’s just as much nonsense, because taxes always occur whenever money changes hands and that phenomenon is not limited to dividends.

Most of your arguments are semantics. Instead of using the common definitions of words, you are having us use different ones. We started as using common language to explain common beliefs and the fallacies thereof.

In addition, you haven’t made a utilitarian argument against capital gains taxes. You have said that spending power is decreased, but is spending power good? Is spending power of people who make investments USED? What is the value in economic activity of letting the person keep money through lower taxes at any stage, versus the economic activity of taxing that money and the government using it? You seem to be suggesting that all that matters is economic purchasing power, but economic purchasing power can keep going up while the economy gets worse and worse, and utility suffers drastically when people are unemployed, homeless, or starving.

Skeith.

I continued to consider your distinction (taxes = money going to/from gov).

In order to come up with a world that avoids the discouragement of investment/saving and ensures that the tax rate is as you say, moneys to the government with no ambiguity, we need only tax consumption

Universe 1 : 0% taxes

Person 1 consumes $100. Person 2 invests $100, and consumes $200.

Universe 2 : 10% consumption tax

Person 1 earns $100, consumes $90, rendering $10 in tax revenue through a 10% consumption tax.

Person 2 earns $100, invests $100 to yield $200, and consumes $180, rendering $20 in tax revenue through a 20% consumption tax.

Government nets $30/300 at point of consumption (everyone is consuming so NPV is irrelevant) = 10%

Person 1 10% effective tax rate = 10% Person 2 effective tax rate

You can add progressivity by a universal deductible, and varying consumption tax rates for various goods (lower rates on food, for instance)

You have avoid distorting savings behavior, and we have a clear definition of taxes.

But skeith, she know what quintile mean so she must be right.

Um, no. You’re changing terms again. I am considering only income tax on wages, not on consumption.

– No-tax world: Person earns $100, invests it all, doubles money next year, has $200 total wages.

– 10%-income-tax world: person earns $100, pays $10 to government in taxes. Invests the remaining $90, doubles money next year, pays $9 tax on the extra $90 in wages. Has $171 total wages. $19 collected by government in taxes, which is 10% of the person’s income. No “double taxation” occurs.

If you want to talk about a consumption tax, that has completely different effects. Completely different effects. Here’s how that works:

– No-tax world: I earn $100 and spend $100. You earn $100 but receive $100 in unearned income, for total wages of $200. I spend all $100 of my money because i am poor, but because you have double my income you spend only $150 of your money. Your lifestyle is 50% better than mine and you still have $50 to continue investing and bringing in unearned income to you.

– 10%-sales-tax-world: I spend my $100, pay $10 in taxes, and have paid out 10% of my income in taxes. You spend $150, pay $15, and have paid out 7.5% of your income in taxes. Furthermore, the actual dollars you paid to the government went down from $19 to $15, for a $4 reduction in government tax revenue. However, this is not the end of the story, because the sales tax heavily impacts the income of businesses, generally reducing the income of the employees, one of which might well be me. Everyone is poorer =except you=. You are $4 richer, at the direct expense of everyone else! So there’s no mystery here while you would champion a sales tax over an income tax.

Sorry, half-typo half-brain fart there. In the 10%-sales-tax world you are $14 richer, not $4, compared against the 10%-income-tax world. The government’s tax revenue is reduced by $4 (not counting the effects on the reduced income of businesses and their employees) which in turn reduces the services it can provide.

“Most of your arguments are semantics. Instead of using the common definitions of words, you are having us use different ones. We started as using common language to explain common beliefs and the fallacies thereof.”

My arguments are not semantics, because I am adding information.

If you prefer, all my arguments are:

You are drawing conclusions from certain metrics that exclude information.

Remember your valid points on the ROI study? How you argued that the article’s definition of ROI was not a good measure of effectiveness of each state’s government because information was excluded (e.g. the make-up of the pitchers) ? I did not claim you were arguing semantics, because you added information (or pointed to excluded information, actually).

“In addition, you haven’t made a utilitarian argument against capital gains taxes. You have said that spending power is decreased, but is spending power good?”

When we trade (our labor, or time) for money, we do so in order to consume the earnings. If you work for money, then you deem what you can do with that money good. If you didn’t you wouldn’t work. Money’s only value is that we can spend it. Otherwise it’s just paper and germs.

If you are going to look at the impact of taxation on an individual, you have to look at the utility they gain and loose as a result of the tax imposed. That is a utilitarian argument. An argument, by the way, that is a good defense of progressive taxation.

“Is spending power of people who make investments USED?”

Yes, it is used to make our lives and the lives of our fellow humans better, and has succeeded beyond our wildest imaginations over the course of history. We owe the vast majority of our physical and material, trivial and life-altering progress to investment. How investment is distributed is determined by demand, IOW, what we value most at any given time. Investment is a pool from which the democratic cauldron of wants is fueled. And it truly is democratic, because the combined consumption of the vast majority is far more powerful than the consumption of the very few.

“What is the value in economic activity of letting the person keep money through lower taxes at any stage, versus the economic activity of taxing that money and the government using it?”

Economically, government spending generates a dead weight loss always, while individual spending generates deadweight loss in few instances (monopolies, externalities). So the value of “economic activity of letting the person keep money” is arguably greater than “the economic activity of taxing that money and the government using it.” This is not controversial. The controversy is on how much dead weight loss there is from gov spending, not its existence.

http://en.wikipedia.org/wiki/Deadweight_loss

As importantly, by taking the decision making power from individuals and handing it to the government you have a distortionary effect on investment, because government doesn’t consume the same things that the individual would have given the choice (if they did, you wouldn’t need to take it in the first place).

Last, but certainly not least, giving government the right to allocate spending introduces an agency dilemma (gov as the agent has an incentive to allocate tax dollars for its own benefit and the detriment of the tax payer.) Again, not controversial.

Please don’t misunderstand. I am *not* advocating no government spending, I am only answering your question.

“You seem to be suggesting that all that matters is economic purchasing power, but economic purchasing power can keep going up while the economy gets worse and worse, and utility suffers drastically when people are unemployed, homeless, or starving.”

No, I am saying that if you are going to measure how taxes affect groups of people in order to start tackling questions vis a vis the “fairness” of a policy you have to measure how that tax affects that person’s consumption, not what is in their IRA. Because what is in that person’s IRA is has no value outside the context of the person using what is in their IRA to consume. IOW, how taxes affect the utility a person derives from their money.

Skeith:

“You earn $100 but receive $100 in unearned income, for total wages of $200. ”

Why am I getting $100 in investment income? It did not magically appear.

At some point that income was generated by labor. It was taxed at that point.

If you want to make an objective measure of the effect of a phenomena, you have to start with a control of 2 people controlling for all outside variables.

By your logic you could prove that a medication had different effects on people because one of the two people in your test wasn’t ill. You did not control for external variables, and are proposing a flawed test.

I notice that you’re now explaining deadweight loss like I didn’t just explain deadweight loss to you. Do you think the fact that I brought up deadweight loss to you, because you obviously didn’t know what it is, has disappeared or something? I mean, it’s not like it wasn’t obvious before that you don’t actually know much about economics, and you’re just throwing about the terminology in hopes nobody else knows more than you, but it’s even more obvious now that I’ve mentioned deadweight loss and that sent you to Wikipedia to look it up.

I also notice you’re not addressing how a change from income tax to sales tax makes everyone poorer except the wealthy person who doesn’t have to spend 100% of her income. We’re not talking about medication here, but if you want to use the analogy I’m comparing the effects of one medication to the effects of another. If you’re going to take meds (if you’re going to pay taxes – and you ARE going to pay taxes unless you love living in a Somalia-like anarchy) you have to choose which med you want. The option to have zero taxation is off the table.

“Why am I getting $100 in investment income? It did not magically appear.

At some point that income was generated by labor. It was taxed at that point.”

First, that’s not true for all, or even most, investment income. You clearly don’t understand how the stock market works.

Second, this notion that “double taxation” in that sense is somehow unique to investment income is total nonsense. I earn money; I pay taxes when I get it. I use the money to buy a car; I pay taxes when I spend it. I own the car for a while; I pay property tax every year on the car. Money is taxed every time it changes hands. I already said this, and I don’t know if you didn’t read it or if you chose to ignore it, but here it is again: “double taxation” in sense you’re now using the term is NOT UNIQUE TO INVESTMENT INCOME.

@skeith: the notion that the stock market “works” in either sense has me rofl

To quote Billy Ray Valentine, “Y’all are bookies!”

Yeah but, no but – it’s actually “we all”.

Like it or not, we all depend on the markets for our superannuation and retirement income.

So that’s why I am not too rabid a Marxist. (Though I may see the world thru marxist coloured glasses)

A mixed economy for me!

@Jack99 – What bothers me most is not that investment income is taxed at a lower rate, it encourages investment and I’m fine with that. It’s that hedge-fund managers, stockbrokers and the like are allowed to count the money they make for doing their jobs (what most people would call income) as capitol gains because they had a hand in defining the term. It really gets me, pisses me off to no end actually, that the rich get to write the rules then scream bloody murder when the unfairness of their definitions are pointed out.

But there is no privilege don’t ya know?

Skeith:

“It’s not semantics. Your 14.5% “tax rate” is comparing a spending power of $200 in a no-tax world versus $171 in a 10%-tax-on-all-income world. The person’s WAGES have gone down by 14.5%

However, in the 10%-tax-world the person’s income is not $200. It is $190. $171 is 90% of $190. The percentage of income transferred to the government (the amount of tax) is 10%.

The difference between the 10% tax rate and the 14.5% reduction in spending power is called deadweight loss. It represents a reduction in total income that doesn’t go to anyone, but just kind of evaporates. All tax creates deadweight loss.”

The inefficiency you refer to is generated by the taxation of income that is not consumed and instead invested. Its burden (consumption power that “evaporates”) is shouldered almost entirely by the earner of capital gains, and not at all by the earner of wages. The $10 that the government taxes on income in year 0, would have been invested by person 2 to generate $20. If at that point the investor had been taxed on consumption at the same rate as the wage earner is taxed on her consumption (10%), the tax would have been $20. We lost $10 due to inefficient allocation, but the investor bears the burden of $9 of those $10.

Yes, this is semantics. It really doesn’t matter how you label it.

A system with both capital gains taxes and income taxes will impose a greater burden on the consumption of a person who pays both than the person who pays only one.

Another way to look at it: income tax effectively taxes consumption from capital gains in advance.

You can argue that this is fair because savers tend to have more income, and that this disparate treatment is another way to make our tax code more progressive (and then defend the benefits of progressivity). But you have not disproved that savers bear a greater burden of taxation than consumers. You can call that burden whatever you want, but it is still there.

“So do most market forces.”

Deadweight loss from market forces occurs only in situations of externalities and monopoly; hardly “most.”

As you say “All tax creates deadweight loss.”

“I don’t know where this argument about double taxation came from, anyway. It’s nonsense by the numbers, and only works if you don’t know basic economics.”

The argument is a standard one from utilitarian economists.

Scott Sumner (in the economist):

http://www.economist.com/economics/by-invitation/guest-contributions/proper-tax-rate-capital-income-zero:

“One of the most basic principles in economics is that the taxation of capital income is inefficient. Taxes on interest, dividends, and capital gains represent a sort of “double taxation”, of wage income. ”

Greg Mankiw (in the NYT)

http://www.nytimes.com/2012/03/04/business/capital-gains-vs-ordinary-income-economic-view.html

Steve Landsburg

http://www.thebigquestions.com/2010/09/14/getting-it-right/

I don’t think these guys qualify as folks who “don’t know basic economics.”

To be clear: I am not making an argument by appeal to authority. I am only countering your outright dismissal of valid points by claiming only someone who doesn’t know economics would make such a point.

“It reminds me of that missing dollar riddle. It’s a trick of the numbers caused by not working the numbers all the way through, or not understanding how the numbers work. The double taxation argument I’ve always heard is that the corporation pays taxes, then distributes the profits (on which taxes have been paid by the corporation) to shareholders, to whom it is now income and they pay taxes on it again. That’s just as much nonsense, because taxes always occur whenever money changes hands and that phenomenon is not limited to dividends.”

Yes, that is another argument for double taxation.

And if you think it is nonsense you haven’t thought it through.

What you are missing is that revenue paid to wages is considered a cost to the corporation and thus not subject to corporate tax.

Dividend payments are not considered costs, and are subject to corporate tax.

Money has “changed hands” twice.

First it comes in as revenue. Then it goes out at wages or dividends.

Both exchanges are taxed when dividends are distributed.

Only one exchange is taxed when wages are paid.

The payment for labor was subject to 1 tax (income), the payment for capital was subject to 2 (corporate and dividend).

This analysis is not controversial.

The folks who want dividends taxed as income would not dispute the double taxation of dividends, they would argue such taxation fosters more progressivity in the tax code, because dividends are earned predominantly by the upper quintiles.

“I notice that you’re now explaining deadweight loss like I didn’t just explain deadweight loss to you.”

No, I am simply applying your view point to the model and showing that the conclusion holds.

“Do you think the fact that I brought up deadweight loss to you, because you obviously didn’t know what it is, has disappeared or something? I mean, it’s not like it wasn’t obvious before that you don’t actually know much about economics, and you’re just throwing about the terminology in hopes nobody else knows more than you, but it’s even more obvious now that I’ve mentioned deadweight loss and that sent you to Wikipedia to look it up.”

You have not idea what I know or don’t or what I looked up or didn’t, so stop allegations.

You also have no idea how to show that the model I described leads to a faulty conclusion, so you resort to ad hominem, yet again.

“I also notice you’re not addressing how a change from income tax to sales tax makes everyone poorer except the wealthy person who doesn’t have to spend 100% of her income. ”

Nope. Income & capital gains versus a consumption tax in my model:

the wage earner is the same 90 = 90

the government is better off: 30 > 29

the investor is better off: 180 > 171

The wage earner’s situation is unchanged, government has more, as does the investor.

“We’re not talking about medication here, but if you want to use the analogy I’m comparing the effects of one medication to the effects of another. If you’re going to take meds (if you’re going to pay taxes – and you ARE going to pay taxes unless you love living in a Somalia-like anarchy) you have to choose which med you want. The option to have zero taxation is off the table.”

To make a determination of the effectiveness of any single medication you always use a control (placebo) which is the equivalent to taking no meds.

If you don’t you are not accounting for confounding factors. This is a basic and fundamental concept in the scientific method.

“Why am I getting $100 in investment income? It did not magically appear.

At some point that income was generated by labor. It was taxed at that point.”

First, that’s not true for all, or even most, investment income. You clearly don’t understand how the stock market works.”

You didn’t answer the question. And you making an unsubstantiated statement concerning the origin of investment capital.

You’ve offered a model (100 wages versus 200 wages+income) that doesn’t measure the effect of anything because the point of departure for both people is different, and you have not controlled for this fact. You have introduced another explanatory variable which makes your conclusion invalid.

To measure the effects of a behavior (consumption versus saving) you need to compare what happens when your subject does one versus does the other. You offer 2 materially different subjects with no control, so you can’t draw any conclusion.

I will repeat. The model I described above that shows that taxing investment income burdens the saver more than the consumer is not controversial. It is accepted by public finance economists, both liberal and conservative. This observation does not discredit the value of extremely progressive wage taxes, even with very large deductibles (say large enough to spare the entire 1st quintile from taxation period) to address of the declining marginal utility of consumption.

I link to Sumner’s Economist article again; he makes exactly this case, more eloquently than I and is a respected authority:

http://www.economist.com/economics/by-invitation/guest-contributions/proper-tax-rate-capital-income-zero

“Second, this notion that “double taxation” in that sense is somehow unique to investment income is total nonsense. I earn money; I pay taxes when I get it. I use the money to buy a car; I pay taxes when I spend it. I own the car for a while; I pay property tax every year on the car. Money is taxed every time it changes hands. I already said this, and I don’t know if you didn’t read it or if you chose to ignore it, but here it is again: “double taxation” in sense you’re now using the term is NOT UNIQUE TO INVESTMENT INCOME.”

But it is. And again, this is not controversial.

You buy a car and the 30K you spent goes to Toyota.

Toyota spent 15K on materials.

The remaining 15K are distributed equally to employees and shareholders.

Wage earners pay income taxes on their 7K share. They pay 1 tax.

Shareholders pay corporate tax as well as dividend taxes on their 7K shares. They pay 2 taxes.

You see 2 transactions when a shareholder is paid dividends, but not when an employee is paid a salary ?

Jamie,

First, I applaud anyone who tries to address issues rationally and starts from a skeptical point when determining the veracity of various claims. Having said this, your analysis on taxation is a little shallow (sorry). As a fellow skeptic chick, please allow me to raise the following points:

On Myth 1:

The argument that Progressive taxation deters work does not depend on a misunderstanding of the marginal tax rates. It usually depends on the assumption of the decreasing marginal utility of money, and is usually applied to the lower income tax brackets, you will see why below.

Utilitarian conomists who believe in the decreasing marginal utility of money basically argue that the utility an individual gets from the first dollar earned is different from the utility an individual gets from the second dollar earned, which is different from the utility derived from the third, and so on. The argument goes something like this. Jane values her time at $X per hour for the first few hours of work, but she values it at $Y for the next bunch of hours where $X>$Y. Her first hours of labor allow Jane to eat(survive). Y is greater than X because once Jane has enough to survive she values her remaining free time more (you can also see that her supply of free time has decreased, increasing it’s cost to her employer, via demand/supply theory). Jane will agree to sell her first hours of work as long as her employer pays her more than $X per hour. She will also agree to continue to work if her employer agrees to pay her more than $Y per hour. If you introduce progressive income taxation, it is certainly conceivable that Jane’s wage will fall below $Y for the second set of hours due to the additional tax, making it not worth her while to work beyond a certain minimum.

This effect of progressive taxation will tend to discourage work at the lower brackets because they are the most likely to have salaries that fall below $Y at the point where the marginal tax rate changes.

This is the generally accepted argument for why progressive taxation discourages work, and does not require any misunderstanding of how marginal tax rates work.

Myth #2

You are conflating consumption taxes and income taxes, and you are ignoring consumption of government services.

True the overall tax burden as a percentage of income includes consumption taxes. And yes, consumption taxes are generally not progressive (although it is worth noting that some consumption taxes are progressive in that certain states offer different tax rates for various basic goods, like no taxation on groceries).

However, if you count non-progressive consumption taxes in trying to evaluate the “fairness” of a tax system then the consumption of government services these consumption taxes drive should also be taken into account. After all, Sales taxes and property taxes are consumed the members of the state. Basically, they are fee for service.

It costs 10-20K per student per year to educate them in public schools, regardless of parents’ wealth. Most people use the roads right about the same amount. Police, courts, etc. are also equally shared. Lower quintiles tend to use social safety net programs more, and are beneficiaries of various aid programs (Medicaid, subsidized food, etc.). If anything lower quintiles use more government services than higher quintiles. Further, the consumption of government services by the lower quintiles well exceeds their overall tax payments (just look at the cost of public education alone).

Bottom line is the upper quintiles are paying for a portion of the childhood education, the safety, and the social safety net that the lower quintiles consume. If the ITEP took into account consumption of government services (e.g. taxpayer funds used to pay the tuition for a child) and other redistributive programs, the picture would be very, very different.

You write that, “It doesn’t seem particularly fair to have the richest people in the state chipping in the least.” This statement is absolutely 100% wrong. Without the tax receipts of the upper quintiles, we wouldn’t be able to spend nearly as much as we do on fundamental programs like education and our social safety net. To be clear: I’m not saying things should be or could be different, but let’s not distort reality.

Last but not least, there is an economic logic for taxing consumption differently than income. The only reason individuals trade labor for income is to enable consumption. Economists view savings and investments are simply delayed consumption. When they are consumed, they will also be taxed via consumption taxes. What can happen is that their consumption occurs when the individual finds herself in a lower income tax bracket (that is precisely when she is using savings and investments to drive consumption), a phenomena which will further distort the picture. This is why it is very, very difficult to draw conclusions of “fairness” from shallow, incomplete statistics such as the chart you cited from the ITEP.

Myth #3

The overall tax collection per capita in Texas *is* lower than in California, that is not a myth.

Cost of living is also much lower in Texas, and jobs are much easier to come by, both high and low wage jobs as shown by a recent Dallas Fed study.

Unless you are adjusting for cost of living, showing a higher overall tax rate in TX than in CA does not prove that individuals in CA are better off (even in the lower tax brackets). As for TX individuals receiving less services… measurements of academic performance and comparisons across states are highly suspect, as they don’t take into account demographics. There is certainly an argument to be made that further investment in education does not necessarily cause better results. Specifically, US ed spending in 1990 was somewhere in the 250 Billion range. In 2005, this more than doubled to over 500 billion (inflation was 50% overall in the same time period). Increases in academic performance commensurate with this increased real spending have yet to materialize. (data source NCES)

The usual anti-TX argument is not this at all. It is that: the TX economy relies heavily on the energy sector, and that it is the strength of the energy sector and not their (classically) liberal economic policies that is responsible for the economic success of TX. One counter is that CA is sitting on some pretty spectacular natural resources as well, they are simply not exploiting them (due to illiberal economic policy). The counter to that is environmental externalities…. and it goes on. But it is by no means a simple cut and dried argument.

Myth #4

Just because the government accounts for deductions as spending does not make it so.

In fact, just because the gov accounts for anything in any particular way does not make it so.

Skepticism is good.

One key difference between a deduction and a subsidy:

A subsidy can be more than the individual’s income, while a deduction cannot be more.

A deduction is tax not paid, while a subsidy is income not earned in the marketplace.

A deduction allows the taxpayer to keep income earned, while a subsidy redistributes to the taxpayer income earned by someone else.

From an economist’s perspective there is a very big distinction:

Welfare is redistributive (taxpayer money given to a third party)

A deduction is not.

Welfare has distortionary effects because they enable consumption of non-market income, while deductions are not (unless they are restricted) because they allow consumption of market income.

Haha, wow. I’ll take these one at a time.

1. Yes. Thank you for explaining marginal utility to me. I’m not sure we got to that in my class with Gary Becker. This myth was about a common misunderstanding of the marginal tax rate. Obviously, taxes have other effects on behavior and the choice on how much to work. I didn’t mention it because that’s not what the myth was about but thank you for enlightening me.

2. What? Consumption taxes and income taxes are two types of taxes? I mean, I wrote that but had no idea. I also was totally ignorant of the fact that the government provides services. I thought we just gave money to the government and then they burned it in an offering to the gods.

3. You’re right. I definitely shouldn’t have gone into the details of the differences in academic achievement between Californians and Texans or said that there were large correlations between spending on education and academic achievement. I mean, I did say those things, right?

4. Yes there are definitional differences between subsidies and deductions. Good thing that is not actually what I wrote about.

Seriously, your entire post is responding to something I did not even write. I get that maybe you think I should have written a completely different post about completely different topics but that’s not what I did. You’re welcome to go write your perfect post yourself.

Your first point is rather confusing, in part due to what I believe is a typo where you said “$X>$Y” while meaning $Y>$X.

In addition, it seems odd that the people who are arguing about progressive taxation are never at the low end of the income bracket. Bill O’Reilly and Sean Hannity are not at the low end of any income bracket, but they are the people saying that they would stop working. Also, your theory runs into past experience showing that when the top marginal tax rate was 90%, people kept working in that top bracket to make more money. Your argument seems to be an argument against raising taxes ever, but not against an actual progressive tax system, since in a progressive tax system, any increase in wage will increase take home pay. Taking it further, it is an argument that any taxes discourage work. Any tax will increase the amount an employer must pay for the employee to get $Y, so this isn’t an argument against a particular tax, but just taxation in general. In that a progressive tax system will have certain points where the amount an employer has to pay an employee so that the employee gets $Y changes slope, I guess you have a point, but this seems like an argument particularly removed from reality.

Also, in a society with extremely high unemployment, shouldn’t we encourage those who are living comfortably to remove themselves from the pool of applicants, in order to increase the pool of jobs available to those who want to work? This just seems like a hugely problematic argument.

Also, the myth that Jamie refuted may not have been your myth, but it is A myth which people believe.

To Hanoumatoi :

Yes, thank you, that is a typo. $Y>$X.

re: FOX news anchors, I can’t speak to people’s motivations for making arguments, I can only speak to the argument. Arguing bias isn’t enough to discredit a logic. It is much more useful to actually discredit someone’s argument based on real fallacies rather than ad hominem.

“Also, your theory runs into past experience showing that when the top marginal tax rate was 90%, people kept working in that top bracket to make more money.”

First, I qualified my argument saying that effects of progressive taxation on willingness to work will be more visible at the *lower* end of the income scale, because these folks are precisely those who will be more likely to find their hourly wage to be < $Y when they get into higher tax brackets. I don't know what you mean by "past experience," although drawing conclusion from observation is pretty tricky in economics due to confounding factors.

Second, I would not be so quick to discard behavioral changes as a reaction even at higher tax brackets. When the price of a good drops, it's supply will drop as well; in addition the degree of the drop will be influenced by the elasticity of the supply of the good. When you tax income, you are effectively lowering the price of a good (labor). At the upper brackets, I think it is safe to assume the elasticity of labor is higher than at the bottom due to decreasing marginal utility of money. So, laws of economics point to a further decreases in the labor supply with increased progressivity in the tax code, all other things being equal.

"this isn’t an argument against a particular tax, but just taxation in general. "

Yes, my initial argument shows that income taxes distort the labor market in general, however, progressive income taxes distort it even more than a flat income tax would. There is no pro or con here, though, just fact. There is a cost to taxation, progressive or otherwise; there is also a benefit.

"Also, in a society with extremely high unemployment, shouldn't we encourage those who are living comfortably to remove themselves from the pool of applicants, in order to increase the pool of jobs available to those who want to work? "

The above is truly a myth worth debunking. :-) The key is that the folks you are trading are not the same. You will inevitably get a decrease in productivity from the newbie employee (compared to the experienced one who has relinquished their spot; there is a reason why those who are employed are employed and those who are not are not: profit motive of employer will means more productive individuals tend to be hired first). This decrease in productivity translates into higher costs of production, higher prices for the consumer, and less investment by the competing entrepreneur in increases in efficiency. Economy wide, both the the newbie and the retiree are consumers paying more immediately and in the long term, with the loss of investment compounding over time. Utility of wages is not measured not in absolute terms, but in their purchasing power, which has just decreased. In short: loosing productivity in an economy is never a good thing.

"Also, the myth that Jamie refuted may not have been your myth, but it is A myth which people believe."

I doubt that anyone who seriously argues the effect of progressive taxation on the supply of labor believes this "myth." Debunking it while ignoring the real argument is misleading, which is why I call it a strawman.

Where are you factoring in the effects of unearned income? You can tax unearned income at phenomenal rates before you reduce investment levels, because unearned income is essentially rent. However, in the US unearned income is taxed at an extremely low rate, with the result that the people who are in the highest income brackets often work for the fun of it, because their earned income is a smidgen compared with their unearned income. That doesn’t stop them working.

Investment income is delayed consumption subject to risks associated with investments, and is not synonymous with unearned income.

Since we have argued over semantics, allow me to point out that according to the US SSA income earned from a business is not considered unearned income:

http://en.wikipedia.org/wiki/Unearned_income#United_States

Capital gains and other passive sources of income are by no means generally accepted as “unearned income.”

Government transfers are generally accepted as “unearned income.”

“Where are you factoring in the effects of unearned income? You can tax unearned income at phenomenal rates before you reduce investment levels, because unearned income is essentially rent.”

In a competitive environment, returns on investment are not rents.

To prove a economic rent you would have to show returns in excess of opportunity costs. In practice it is pretty difficult to distinguish the difference between profit and rent. However, we can examine mechanisms by which rents may develop. Given the liquidity and competition of modern capital markets, that’s a tall order. If economic rents were contained in a large portion of investment income then there should be a mechanism allowing such a phenomena to occur.

I see only one such obvious mechanism and that is government distortion via licensing and patents. But the solution would simply be to eliminate spurious patents and get rid of the vast majority of licensing. Voila, no more rents, and a more efficient market (and no dead weight loss from taxation).

“However, in the US unearned income is taxed at an extremely low rate, with the result that the people who are in the highest income brackets often work for the fun of it, because their earned income is a smidgen compared with their unearned income. That doesn’t stop them working. ”

If you decrease income on a particular behavior, high income individual or not, you will disincentivise that behavior. In you tax investment income you will decrease investment. Will you also increase work from those individuals? Possibly, when their not higher cost of leisure is less than the compensation they command in the labor market. There is a cost (less investment, less productivity, compounding in the long term). Since taxation carries a dead weight loss, agency risk, distortionary effects (reducing investment) the net to the economy of greater investment income taxation will be decreased productivity, higher costs to the consumer, slower economic growth and slowed progress.

You realize that the Wikipedia page doesn’t list all sources of unearned income, right? I mean, that’s not a comprehensive list and it doesn’t claim to be. Unearned income is income you did not earn by labor. But even the Wikipedia page (for reals, you’re learning economics from Wikipedia?) says “unearned income is all income that is not earned from your job or from your business.” Let me say that again. “unearned income is all income that is not earned from your job or from your business.” I own shares of GE. GE is not my business. The investment income I get from GE is not coming from my business.

Holy cow, you honestly are arguing without knowledge.

I’m not discussing this with you anymore. You need to take some econ courses, and stop looking down your nose at people like mrmisconception. mrmisconception was up-front about not being a statistics expert, but you’re presenting yourself like an econ expert when you only know as much about this as you’ve learned from Wikipedia. For reals, go read a book.

Ha, but do you know what quitile means?

“You realize that the Wikipedia page doesn’t list all sources of unearned income, right? I mean, that’s not a comprehensive list and it doesn’t claim to be. Unearned income is income you did not earn by labor. But even the Wikipedia page (for reals, you’re learning economics from Wikipedia?) says “unearned income is all income that is not earned from your job or from your business.” ”

I take it you think wikipedia is an invalid source ? I just picked it because it’s convenient, but please point to a better one.

Still, while I have that wikipedia page open:

“According to certain conceptions of the Labor Theory of Value, it may refer to all income that is not a direct result of labor. In a neoclassical frame, it may mean income not attributed to any factor of production. Generally it may be used to refer to windfall profits, such as when population growth increases the value of a plot of land. ”

If you agree with to the labor theory of value, then your definition of unearned income is ok. Then again, you also hold that the value of a good or services is only the labor required to produce it… IOW, supply and demand do not determine the value of a good. The labor theory of value has been criticized and is not generally accepted as valid.

“I own shares of GE. GE is not my business. The investment income I get from GE is not coming from my business.”

Yes. If you own shares of GE, you own a part of GE. That is precisely what owning a share of GE means. It is “your” business.

“Holy cow, you honestly are arguing without knowledge. I’m not discussing this with you anymore. You need to take some econ courses, and stop looking down your nose at people like mrmisconception. mrmisconception was up-front about not being a statistics expert, but you’re presenting yourself like an econ expert when you only know as much about this as you’ve learned from Wikipedia. For reals, go read a book.”

If someone claims to believe something and has no basis for this belief other than just because he believes, then I call religion.

I don’t look down on Mr.mis, I just think he’s a preacher.

I have nothing against preachers until they start trying to claim equivalency with science and logic.

I have nothing against creationists either.

But when they start to claim that creationism is equivalent to science, I will certainly point out it is not.

Further, not only have I never presented myself as an expert, you don’t know my level of expertise. I don’t know yours either, but you don’t see me calling you ignorant, even when I disagree, do you? Why not make a point and substantiate if you can instead of resorting to ad hominem? Is that just your a last resort when you can’t make a case for your point of view?

We’ve now established you don’t have a logical counter to my arguments, so far.

Instead of saying, ok, that’s interesting, let me go think and see if I can find a flaw, you argue I am no authority, and so what I say has no validity. It’s an ad hominem fallacy, pointing to a (perceived) quality in your opponent that is irrelevant to the argument in order to discredit them.

And it is not sufficient to prove me wrong.

“I take it you think wikipedia is an invalid source ?”

I take it you think it is? Do you realize that I can go in there right now and change the page so that “investment income” is listed? And unless you personally dive in there to revert it that will go unchallenged, because investment income is unearned income?

Bringing up labor theory of value and arguing against it is strawman logic, as I have never subscribed to it nor did I give you any indication that I did.

“Yes. If you own shares of GE, you own a part of GE. That is precisely what owning a share of GE means. It is “your” business.”

LOL you’re too cute. Go buy a share of GE and then walk into the corporate office declaring that this is YOUR business and you therefore get a say in how it is run. They will laugh the entire time they are escorting you off the premises.

“Further, not only have I never presented myself as an expert, you don’t know my level of expertise.”

I know that you were wrong about your original double-taxation post because you didn’t know about cost basis. I know that you were subsequently wrong again because you didn’t understand the relationship between taxation and wages. I know that you didn’t know what deadweight loss was until I told you about it, and then you ran to Wikipedia to look it up and subsequently elected to hold a lecture on the topic in the direction of Hanoumatoi, as though you became an expert on the topic by virtue of having read the Wikipedia page.

I know that you were wrong yet again because you don’t comprehend what unearned income is, and by all appearances this lack of knowledge is due to you relying on Wikipedia again.

I know that you were wrong yet again because you have no conception of how markets work.

I think I have a good general idea of your level of expertise.

“We’ve now established you don’t have a logical counter to my arguments, so far.”