On Ungrateful Brats: Are College Students Really Adults?

The Rachel Canning case has set off a social media shitstorm, to say the least. Yesterday morning, a judge denied the preliminary request made by the teenager who sued her parents for support, and most commenting on the case have made it clear that they think that she is a spoiled brat. One of the most common criticisms that I have seen levelled against the young woman is the idea that because she’s 18, she is an adult and therefore ought to be responsible for her own college tuition.

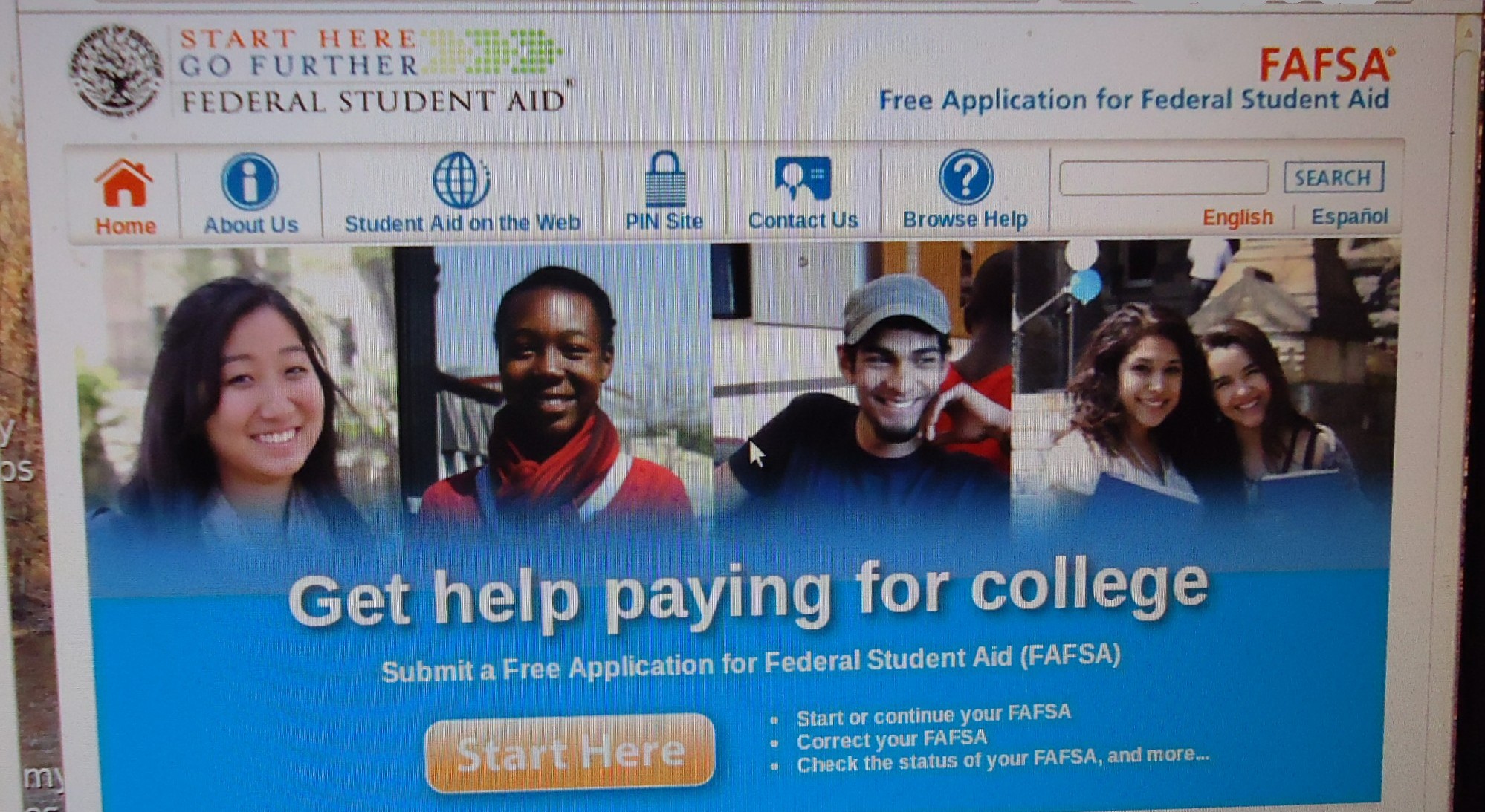

While I cannot speak to the details of the case, I can speak to one simple fact: In the United States, undergraduate college students in their early 20s are not treated as adults by the financial aid system.

All government-associated aid for American college students, no matter what their age, is handled through the Free Application for Federal Student Aid, or FAFSA. In order to file FAFSA, you need tax return information. If you are an undergraduate student under the age of 24 and are not legally emancipated, you must provide your guardian’s tax return information in order to apply for aid, even if they have thrown you out without contributing a penny towards your education. The only way to get around it is to either get emancipated or get an override, neither of which are easy tasks. If you forgo the option federal aid, your other option is to obtain private loans, loans that require either a co-signer or a decent credit history. Scholarships and grants can be an option for some students, but such awards often hardly make a dent in tuition costs, let alone cost of living, books, and so on.

I know this from personal experience. As a nineteen-year-old, I found my living situation with my parents to be unbearable, to put it delicately. I wanted to file FAFSA but my parents refused to share their tax information with me. The financial aid office asked me if I had police records or testimony from a religious community leader to prove that my situation had so deteriorated; I had neither (especially not the latter, since the reason I had issues were to do with my deconversion to atheism). I ended up unable to get aid through FAFSA — I could’t even file — and so I took out private loans. I was lucky in that I’d had a credit card since I had turned eighteen and thus had built up a credit history worthy of a private student loan. That single year of education set me back quite a bit and ensured that I began my professional life in serious, unsubsidized debt. My loans are considered “private” and thus are not be eligible for forgiveness or deferment of any kind, neither through becoming a teacher nor through the reforms passed by President Obama. At the same time, they are still considered “student loans” and thus cannot be forgiven even through the declaring of bankruptcy.

On the flip side, students whose guardians are willing to provide their tax information for FAFSA and get subsidized loans and aid, then, if they so choose, are able to go on to graduate school and get aid based on their own personal incomes, free of crushing private debt. I’ve known students who continue to live with wealthy parents through their postgraduate education but claim only their paltry personal undergraduate income on their grad school FAFSAs. I’ve known students who comes from wealth who traveled on their parents’ dime and worked low-wage jobs until they hit age 24, then applied to school using their low personal income to ensure that neither they nor their parents had to pay much, if at all, for school. It’s yet another perpetuator of the cycle of wealth and inequality.

If I could go back and do it over, I might’ve lived a little more frugally than I already had been, but I wouldn’t have dropped out. As hard as it was for me to get a job as a millennial in a recession, I wouldn’t have been able to eventually get the job that I have had I not had my degree. Without it, I might’ve ended up stuck living paycheck-to-paycheck in retail purgatory, unable to help my partner out of homelessness.

The way in which the post-secondary undergraduate student financial aid system is set up heavily disadvantages students who come from already-difficult backgrounds. It ensures that filial stability is rewarded financially. Those with less fraught family lives are able to continue having easier lives, while those with issues find their lives being made more difficult.

Being that I’m immersed in this story due to work, I assure you the details are pretty ugh. However, that being said, the contradictory treatment of 18 to 25 year old individuals in this country is absolutely just as ridiculous.

I do not believe that it is correct that you have to prove you are emancipated in order to get student loans without providing parents’ tax information. I think what you have to prove is that you are not a “dependent” of your parents. Parents can keep taking an exemption on their tax returns as long as you are a dependent. And, if you are a dependent, then you can’t claim to be independent for the purposes of securing loans. I.e., you can’t claim to have zero income for loan purposes when you live rent free at home and have all your bills and expenses paid for by your parents. To jettison parents in the tax realm, you just need to file a tax return that states that nobody can claim you as a dependent and if your parents claimed you as a dependent while you were not living under their care, then they’d be committing a tax offense. You can also provide evidence to the student loan office that you reside outside of your parents’ home, that you earn your own money and pay your own bills and are thus not a “dependent.”

That is different than the concept of “emancipation.” Emancipation occurs automatically at age 18 in most states, and can occur earlier if a person makes application to a court and demonstrates the legal requirements. The thing in New Jersey is that there is some legal authority that a person over 18 can be considered legally not emancipated if certain circumstances exist. That would mean that the parents still have a legal obligation to support the unemancipated child. That’s what this woman is trying to show. She is claiming that she is still unemancipated under the peculiarity of New Jersey law.

The parents are saying that she moved out, they don’t contribute to her support, she refused to defer to their authority, etc., and as such she is emancipated by virtue of being over the age of 18 which is the general rule.

Honestly, I never thought I’d say this, but I do think that college “kids” are coddled these days. I never thought I’d be a “back in my day” person, but I am. “Back in my day” we took more courses on average. Graduating in four years was normal. If you needed to, you worked your ass off to pay for school. You drove beater cars, and your parents showing up at school to help you get by was an embarrassment. Most of us, as a matter of course — at least in the circles I traveled — acted like we were obligated to support ourselves, and if we needed something we figured it out.

I don’t know what this woman in New Jersey suing her parents is thinking. But, I have a feeling that a few years down the road she is going to feel the humiliation and shame that she is ignoring right now. I say, “You’re 18 years old. By that age, you should be able to feed, clothe and shelter yourself. And, college is not a right. Even if you’re a dependent on your parents, that doesn’t mean they have to think college is best for you. Move back home, and if you want them to pay for stuff, then you’re going to have to do stuff they’re willing to pay for. Maybe they want you in military school. Sounds like you need it. “

Based on your commenting history, I’m starting to strongly suspect that you skim rather than read my pieces.

As I stated, the “proof” required to be considered not a dependant of your parents is quite extensive. It’s not as simple as coughing up financial statements that demonstrate that you support yourself without your parents’ help. You have to show police records that your parents are abusive or statements from community leaders, like religious leaders, that show that your parents have thrown you out. Otherwise, too bad. I learned this from experience whereas you are speaking hypothetically.

Disagreement doesn’t mean we have to be insulting. Maybe I’m not great at reading and didn’t understand your post. It’s much nicer to be pleasant than to pepper one’s posts with express and implied insults.

But, regardless, the disagreement doesn’t much matter. Parents of 18 year olds, even in the best of circumstances where a child resides in the home and everyone loves each other — parents don’t have to send their kids to college. They might not have the money. They might not care for college, and they may think their child is better off somewhere else. Parents aren’t blank checks that get to pay for everything their children want to do, even college.

I did not insult you in any way. Your “get a job” and “darn kids these days”-type statements are hardly pleasant, by the way.

Your opinion on what parents should or shouldn’t provide for their children is separate from my point: which is that the financial aid system treats students like children, something you denied despite the evidence. Instead of addressing the main point, on which you insisted on being wrong, you moved on to another point, i.e. parental obligation, one that is not the one in contention on this post.

You are being sooooo generous here.

That’s not sarcastic by the way. You are being far more generous than I think said person deserves.

Contemplative1, your information about independent status for financial aid recipients is as out of date as your attitude toward college “kids these days”. ;)

http://collegeapps.about.com/od/payingforcollege/f/independent-status-financial-aid.htm

dude, shut the fuck up. you’ve no idea what you’re talking about, and all you’ve been doing around here is bullshit and JAQ off.

Here’s the FAFSA definition of “dependent student”: http://studentaid.ed.gov/fafsa/filling-out/dependency

so if you’re an undergraduate student born after 1991, not married or a parent yourself, not in the military, not an orphan or living in foster care or determined by social services to be homeless/self-supporting, and not emancipated, you’re a dependent. Otherwise, you’re independent.

None of the BS you’re talking about. Your own income is irrelevant; how you file your taxes is irrelevant; getting money from your parents is irrelevant; where you live is irrelevant. This is not about dependent status on taxes, this is about the FAFSA. Jesus fuck.

“The argument (she) is making is that she didn’t leave home voluntary. She’s saying ‘I was thrown out,'” Hagan said.

My response to that would be “so what?” If you turn 18 and your parents say, “we’re done. You’ve been raised, you’re an adult, and you’re out,” then so be it. The child is now emancipated. Nothing in the law says that it has to be the “child’s” own decision after the age of 18 to remove herself from the scope of her parents’ authority. The parents are not indentured servants, that must support an 18+ year old person until it pleases the little shit to move on….

This case is bollocks. It’s headed out the door. The allegations of “abuse” were determined as unfounded by Child Protective Services according tot he article, and even if the allegations were found to be true, this person is now 18, and if the parents remove that person from the scope of their authority, then that’s the end of it. Move on. Get a job.

They might legally be an adult, but unless they have specific evidence proving a particular sort of extenuating circumstances, they are unable to file FAFSA without theirs parents’ tax information (and parents who throw their kids out at or after age 18 can withhold said information to punish the kid). Period. If you doubt me, check out the various financial aid websites or visit a college/university near you and talk to their financial aid officers.

Again, in the context of this case, so what if that’s true? Even if the parents hadn’t thrown her out, they still wouldn’t be legally obligated to give her their tax information or help her with the FAFSA application, and they wouldn’t have to pay for her college.

I think a lot of things suck about the student loan system, and where I agree with you is that the student loan system does deem people dependents who may in actual fact not be. But, that warrants a major change in the student loan system, not any sort of a court order requiring parents to foot the tuition bills of their 18 year old children.

Exactly 3 sentences of my 29-sentence post were dedicated to the case in question. I transitioned from talking about her with “While I cannot speak to the details of the case”. My point, i.e. the main point of this piece, is about the financial aid system. I said nothing about her after the first paragraph. I was not arguing anything regarding what I think the outcome of the Rachel Canning case ought to be because I do not know enough about it (and, in my opinion, no one knows enough about it) to speak to it.

O.k., well let’s reach a place where we can find agreement. I agree with you that the financial aid system needs to be overhauled.

I’d hardly call this agreement. You began with a false premise and have yet to admit that you were wrong and insisted on derailing with arguments that have nothing to do with your initial false premise. But okay.

Contemplative – you are definitively wrong. It seems like you are hypothesizing how it should work. I agree, that is how it should work. However, that is NOT how it works at all. It is near impossible to get financial aid without your parents input. And even if your parents won’t give you a penny, their income affects your ability to get financial aid.

And don’t get started with “back in the day” – price inflation of college is huge compared to price inflation of everything else. Even a college student working 40 hours while taking 4 classes could hardly make a dent in tuition.

How is an 18 or 19 year old supposed to “figure out” college when there are no resources available if their parents don’t want to be involved at all. Tell me. Stop being so judgemental.

Let’s assume that is true. How does that effect the case we’re discussing? The Cannings have to pay for their daughter’s tuition? They have to hand over their tax information? Why would they have to do that when they don’t legally “have to” do that even if the kid didn’t move out of the house. Nothing says parents have to agree to help their kids through college.

And, as for price of colleges, it depends on the college. There are definitely colleges out there these days that are affordable. You might not get your first, second or even third choice, but then again that’s not something that’s new under the son. Far more people go to college now than did 30 and 40 years ago. It’s easier to get in, more people get educations and more people get government assistance. Part of the reason why tuition has skyrocketed has been the increase in government funding and subsidized student loans.

I’m not being judgmental. How is an 18 or 19 year old supposed to figure out college? Maybe delay attending for a while. That’s one option. Another option is to not go, and do something else. Another option is to work and go at night. People have done that and taken six or seven years to get through a bachelor’s program and they did it, working full time during the day.

Remember, I’ll say again, even if her parents had a good relationship with her, they would be under no obligation whatsoever to provide her with financial assistance to attend college. They would have no obligation to give her copies of their tax returns or other financial information. They could disagree with her choice of college, and tell her they’ll only pay if she goes somewhere else.

She can apply for scholarships, which often go uncollected due to lack of applicants. She can apply for private student loans. She can get a job and work for a year to establish credit and to prove true lack of dependency. She can file a petition in a New Jersey Court seeking a determination that she is emancipated, and then apply for student loans once she has the court order. If she’s been kicked out of the house, is living elsewhere, and gets no support from the ‘rents, then that should be a fairly easy legal matter. Here, she is trying prove that she is NOT emancipated, and then she claims that by virtue of not being emancipated her parents have a legal obligation to pay her tuition. A better move would have been to file a petition for emancipation, get a hearing as soon as possible, get a determination of emancipation and then apply for student loans (if she wants to go to college) based on that legal determination. The fact that her parents can’t declare her as a dependent for tax purposes coupled with the court determination of emancipation ought to be enough.

Her relationship with her parents is now irreparably damaged, it seems. She was suspended from school for truancy, after her parents tried to force her to attend high school classes, and now she alleges in court documents that her parents are refusing to provide her with an education. If she was so concerned with her education, why didn’t she just show up to class? Instead she skipped school with her boyfriend and they both got suspended from school. Then she moves in with a friends’ parents who are now footing the legal bill for the kid to sue her parents. Wow. Amazing. Those parents must be living a nightmare. My gut reaction is to question what those parents did to create such a little monster, but I think we all know that sometimes kids can be raised just fine and still turn out wrong.

My hope is that she sees the light and steps back and realizes that she’s acting like an entitled primadonna. She should apologize to her parents, grow up a little, and take some time off to reach a modicum of emotional maturity before attending college.

“She can file a petition in a New Jersey Court seeking a determination that she is emancipated, and then apply for student loans once she has the court order.”

At least I’m glad you now acknowledged that you are wrong and that a student would have to file legal documents seeking emancipation (unlike what you claimed earlier). And doing that is neither free nor easy and another roadblock in a difficult process.

“There are definitely colleges out there these days that are affordable. ” Again, even state schools are becoming prohibitively expensive. With a handful of exceptions around the country, we are still talking AT LEAST 5k a semester. But yes, it is affordable and doable. But not so much if you are not even eligible for federal loans. And it would be very hard for an 18 year old to get a private loan without a history of credit or a cosigner. I actually don’t know any student who’s ever gotten a private loan without a cosigner unless they worked for several years first to establish a history and went to school later in life.

Also, I’d like to see some of this data on scholarships not being taken … really? And just so you know, MOST SCHOLARSHIPS REQUIRE A FAFSA on file. Again, without your parent’s cooperation you can’t file a FAFSA unless you are emancipated.

Can you stop being an arrogant know-it-all about things you are clearly conjecturing about?

It is a weird system that doesn’t treat 18+ year olds as adults and penalizes them if they don’t have cooperative parents EVEN IF said 18 year olds are super responsible and do everything right. I sadly have quite a few friends who were in that boat: disowned for no being religious enough, parents with old fashioned views that think they should do it on their own (and like you didnt understand that they at least needed to cooperate in the system even if they didn’t want to help financially), etc. These people were hard working, not spoiled, and should not be penalized. The system is broken for these peopel.

Actually, I just looked it up. Legal emancipation isn’t even enough for the department of education.

And once you are 18, I don’t think there is a means to get legally emancipated in court (correct me if I’m wrong).

Here are the rules:

The status of “emancipated minor” is not recognized by the U.S. Department of Education for financial aid purposes.

To be considered an independent student at least one of the following must apply:

You are 24 years of age or older by December 31 of the award year;

You are married on the day you apply (even if you are separated but not divorced);

You are or will be enrolled in a master’s or doctoral program (beyond a bachelor ‘s degree) during the school year;

You are currently serving on active duty in the U.S. Armed Forces for purposes other than training; or

You are a veteran of the U.S. Armed Forces (“veteran” includes students who attended a U.S. service academy and were released under a condition other than dishonorable).

You have children who receive more than half their support from you;

You have dependents (other than your children or spouse) who live with you and who receive more than half their support from you.

At any time since you turned age 13, were both your parents deceased, were you in foster care or were you a dependent or ward of the court?

As determined by a court in your state of legal residence, are you or were you an emancipated minor?

As determined by a court in your state of legal residence, are you or were you in legal guardianship?

At any time after your junior year in high school, did your high school or school district homeless liaison determine that you were an unaccompanied youth who was homeless?

At any time after your junior year in high school, did the director of an emergency shelter or transitional housing program funded by the U.S. Department of Housing and Urban Development determine that you were an unaccompanied youth who was homeless?

At any time after your junior year in high school, did the director of a runaway or homeless youth basic center or transitional living program determine that you were an unaccompanied youth who was homeless or were self-supporting and at risk of being homeless?

“There are definitely colleges out there these days that are affordable.”

AHAHAHAHAHAHAHAHAHAAAAA…… I went to an “affordable” university. I’m still $17000 in debt. Because “affordable” is a fucking lie.

“more people get government assistance”

you’re trolling, aren’t you. government assistance pays for a tiny fraction AND YOU CAN ONLY GET IT THRU THE FAFSA, which you can’t use when your parents don’t cooperate.

“Another option is to work and go at night. ”

you’re a joke. There ain’t such a thing as a job you can have w/o a college degree that will pay for college. Hell, there’s barely any such thing as a job nowadays. Youth unemployment is ridiculously high.

“She can apply for scholarships, which often go uncollected due to lack of applicants.”

That’s because they’re all highly specialized, not because there’s more money floating around than is needed.

No one is discussing the case but you. This piece is about that status of students in the American financial aid system, not Rachel Canning.

Fair enough. My apologies. I’ll move on. Anything more I say will just be repetitious.

I am one of those 18-25 year old American students with financial aid, and I can’t imagine how hard it would be to do FAFSA without my parents. I’ve found it a lot like Heina has laid out: it is possible to file for aid without your parents, but it is a lot harder. I don’t get any money from my parents, but my dad is an accountant (a huge advantage), and they can teach me about taxes, the differences between loans, and what sorts of information I need to qualify for the loans I need. While that system works out for me, it is only because I have an amicable relationship with my parents. I have seen friends thrown out of their homes at 18 with no money, no car, and no guidance. Its a scary and difficult situation. Are their parents doing something illegal? No, not that I know of, but most of those kids that I knew became dependent on other people to get/find work, wrench necessary documents from their parents, and navigate an educational system that really really seems to want to trick you all the time. In fact, I think its kind of messed up that parents can just wipe their hands of the people they raised for decent people in the community to pick up and finish the job, but that’s just been my experience.

and for the record, I was considered an independent student when I started doing the FAFSA at 21; cuz I was married. Not a solution I’d suggest to anyone (divorces are useful tho :-p )

There was some effort for reform FAFSA

http://www.diamondbackonline.com/news/campus/article_b259570c-6091-11e3-bd21-001a4bcf6878.html

https://www.govtrack.us/congress/bills/113/hr3446

My last semester of college (I was either 21 or 22 years old), there was a financial-aid “mix-up” and I had to take out a quick private loan. Even though I had been living on my own since I was 19 and was as financially independent from my parents as could reasonably be expected given that we were not estranged, and even though my parents had just gone through a personal bankruptcy that completely ruined their credit, my parents still had to co-sign for that loan.