Sequester? I Hardly Knew Her!

As probably the only person on the planet that thinks government budgets are interesting, watching the last couple months of budget negotiations in the US Federal government have been really fascinating, extremely frustrating, and super terrifying. Even worse, every time I go on facebook or twitter I see a multitude of myths and misunderstandings regarding the Sequester negotiations being passed around by good intentioned people. This misinformation has got to stop, and if no one else is going to address it, it might as well be me.

I also want to add as a disclaimer: I worked as a staffer on the Obama Campaign for most of last year, so I’m clearly biased towards the Obama Administration. However, now that the election is over I no longer have any official position nor am I being paid by the campaign, the Whitehouse or any other organization connected with the president, the DNC or any other political organization. I am a free agent now and everything I write here comes from my own expertise in tax and budget policy and research.

What is the Sequester?

Back in 2011, Congress was in difficult budget negotiations that seemed nearly impossible to solve. Instead of actually negotiating right then and there, they decided to push the decision until the end of 2012, after the November election, thinking that it would be easier to come to an agreement with the election behind them. To make sure they would actually come together in a true negotiation, they came up with something that has colloquially been called the Fiscal Cliff.

The Fiscal Cliff was essentially a law passed by Congress that said that unless they came to an agreement before New Years, devastating budget cuts and high tax increases would take effect. The idea was that faced with utter disaster, republicans and democrats would come together in solidarity and save the country. Instead, just after New Years, they passed a law allowing some tax increases and pushed the budget cut portion of the fiscal cliff back to March 1, 2013. The Sequester is the cuts that were to take effect in March if Congress did not act to avoid it.

Now that March 1st has come and gone without an agreement, the Sequester has taken effect. However, the cuts were designed to happen slowly over many months, so the effects might not be obvious right away.

Additionally, it’s worth mentioning that there are two types of government spending: Mandatory and Discretionary. Mandatory Spending is spending required by law. It is not considered during budget negotiations and can only be changed by changing the program it funds. This includes things like Social Security, Medicare and Medicaid. The Sequester does not affect anything that falls under Mandatory Spending. Discretionary Spending is what we typically think of when we think of lawmakers negotiating a budget. If they wanted to, they could double the budget or cut it in half. The $1Trillion in sequester cuts goes entirely to programs funded by Discretionary Spending.

The Sequester will activate $500B in cuts to Defense programs and $500B in* cuts to domestic programs. Additionally, agencies don’t get to decide what types of things within their organization will get cut. The cuts will affect all programs within an agency equally and money cannot be moved from a less important program to a more important one except in a couple special instances. This means that under the Sequester, for all non-exempt programs, projects, departments and agencies, everything will have a decrease in funds.

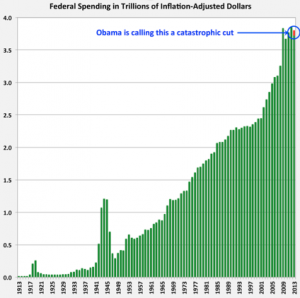

I saw this chart on Facebook that suggests the Sequester cuts represent only a very tiny portion of government spending. If it’s so small, why is it such a big deal?

This chart seems to have been popular on social media among those saying that the Sequester doesn’t matter. It also happens to be incredibly misleading. I don’t even want to get into the fact that looking at the budget over a 100-year span without considering GDP is completely deceptive. That doesn’t really have anything to do with the Sequester though so I’ll ignore it for now. Basically, the only part of this graph that matters for our discussion is the very last 2013 column.

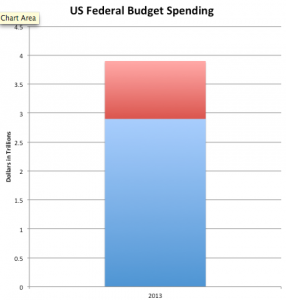

If you check out the US Government Budget for FY2013 you’ll see it totals to $3.9 Trillion. Their 2013 column seems just a bit lower than this, but it’s close enough for the internet. As I mentioned earlier, the Sequester represents $1 Trillion in cuts savings over 10 years. This is about 25% of the entire CBO estimates this to be about 10% of the* 2013 US discretionary spending budget. That little red bit on the chart looks like about 2% so they are off by an order of magnitude a lot. Whoever made this chart was either intentionally attempting to mislead or is really bad at math.

Hey look, I can make a chart in like 2 seconds with accurate numbers:

The deficit is bad, so how could something that lowers the deficit be bad?

The sequester cuts government spending so it also greatly reduces the deficit. The question is really over whether a mandatory 25% cut to literally every single thing the government does is really the best way to be reducing our deficit.

First of all, these are cuts that happen fairly quickly with little warning. A negotiation in cuts to a program that a lot of people depend on would typically be phased out over a long period to give employees time to find new jobs and States or nonprofits the opportunity to pick up where the federal government left off. Instead, under the Sequester, we are looking at immediate furloughs for employees and cuts to government benefits that no one is really ready for.

Additionally, without the option to choose what is being cut, cuts cannot be selected in such a way that would minimize the impact on the economy or government services and decrease inefficiency. Consider, for example, treatment for people with mental health. If people who are mentally ill are able to get treatment, they are more likely to be working and contributing to the economy and paying taxes. When we cut these programs, we might gain some funds we are no longer spending, but we also lose some tax dollars, which minimizes any gain we might have had, to say nothing about the people who now are unable to get the treatment they so badly need. Some programs are more efficient to cut than others and some programs are more disposable than others. We’re far better off picking and choosing what gets cut rather than letting across the board cuts go into effect.

Isn’t it better to get the Sequester budget cuts than to get no cuts at all?

This is a false choice. The only way to get rid of the Sequester is to negotiate a package of budget cuts and tax increases. There is no “no cuts” option. The real question would be “Is it better to have across the board 25% 10%* cuts or to negotiate an equal package of cuts and taxes of our own choosing?”

If the sequester goes through, what will happen? How does this affect me?

If you are a government employee, you can expect furloughs. Once a week or so, you will be forced to take a day off of work for no pay. If the Sequester goes on long enough, you might be temporarily laid off. I really hope your salary wasn’t important to your own wellbeing or that of your family. Good luck with that.

If you aren’t a government employee, you’re not completely off the hook. You’ll start to notice some minor inconveniences like extra long security lines at the airport since a bunch of the TSA employees will be home on their furlough day. If your child’s school receives federal money, their class sizes might grow and their afterschool programs canceled as teachers are laid off. If your child is in a special education program, that could be cut.

If your house catches on fire, you better hope that your firefighter is not on his mandatory day off because the federal funds they get were greatly reduced. If you’re a college student on work study, you might see a reduction in your financial aid. If you are a low-income woman, you may no longer be able to get breast and cervical cancer screenings.

You know those vaccine clinics that Women Thinking, inc has done at past skeptic events like TAM and Dragon*Con? Those vaccines were paid for by the CDC, and many of them don’t just go to us, but to children who live in poverty and cannot afford them otherwise. Like all other government programs, under the Sequester the CDC will not be able to afford to vaccinate as many children for whooping cough and measles.

We all celebrated last week when the Violence Against Women Act was renewed, but under the Sequester, funding for that program will be cut and many women will go without the support services they need. Are you a scientist? Do you depend on NSF grants to get the funding for your research? Well, good luck because just like everything else, the amount of money going to NSF grants will be cut by quite a bit. I could go on naming more programs that will lose a lot of their funding, since pretty much everything the US government does will be included, but I think you get the picture.

Overall, this huge contraction in government spending and subsequent uncertainty is really bad for the economy. I have seen many different estimates for exactly how bad it might be, but since I’m not a macroeconomist myself, I don’t really have any good way of parsing through the numbers. So for now lets just assume that massive budget cuts and layoffs will probably be bad for the economy as well.

Ok, so what do you think Congress will do now?

I don’t know. Seriously, I have no idea. I cannot see into the future and politics isn’t really my area of expertise (I’m more of a policy girl), so you’ll have to check your favorite news outlet or political bloggers to get an answer to this question.

As an apology, please accept this photo I took of a kitty yawning. Her name is Leela because she has only one working eye.

When I started this post, I said I find budgets interesting but I didn’t say why. The reason is because a simple 256 page document with lots of pie charts and lists of numbers is what decides how we experience our interactions with the government, whether its how long we’re going to wait in line to get through airport security, financial aid so we can go to college, or how many children will be vaccinated in our community. The Sequester isn’t just a bunch of arbitrary numbers on paper. It is people’s jobs, teachers, domestic violence support, first responders and research grants. These numbers really mean something for the people affected by these programs.

Featured photo of Leela taken by Jamie Bernstein.

*Edit: Pingje in the comments pointed out that it is $1 Trillion in savings over 10 years and not $1 Trillion in immediate cuts. Apparently I should be getting my information from Wikipedia rather than reading through CBO reports. CBO estimates are that this represents about 10% of the 2013 budget (although it will feel higher since we are already partway through the year). Sorry for the mistake. Please accept this 2nd adorable Leela photo as an apology:

Isn’t it 1.1 trillion over 10 years?

http://en.wikipedia.org/wiki/Sequester_(2013)#Overview

Oh, that actually makes so much more sense. I should have just read Wikipedia from the beginning instead of going right to super long and complicated CBO reports where I was bound to miss something! Give me a min and I’ll update.

As a person paid by NSF and NASA to do all the awesome science research and outreach that I do… my salary and work is in jeopardy of getting shrunk down. I will still do as much awesomeness as we can afford, but it’s concerning to try and not lose good people to unemployment within our fields. And I can’t just “take a day off” in academia if I get a pay cut. I’ll just keep working harder and budget myself tighter so I have less money to give to our struggling American economy. So :-P to the sequester. :-P to it all.

Yah, most of the list of programs cut by the sequester leave out the NSF. I’ve seen friends of mine on Facebook that are scientists whose grant money depends on the NSF saying that the sequester is just not a big deal. I don’t think they realize what a big effect this is going to have on already underfunded science research.

Yeah, we are beginning to freak out here in the chemistry world. Particularly, my adviser that still needs a grant for tenure next year. Also, my friends that work at a national lab are beginning to squirm. Yikes. This be bad.

Come on Jaime, you’re not the only person on the planet who finds government finance interesting. Though we are admittedly an odd breed.

It is true, there are other crazy people out in the world! By the way, have you ever read the Michigan budget? It’s only like 20pages long and has basically no information in it. If you’re ever having a bad day and feel like yelling at someone, call up the Michigan budget office and ask them what percent of the State budget goes to education. They’ll insist it’s in the budget. Tell them it’s not and they’ll get out a copy of the budget and try to find it. Fun fact: it’s not in there but they’ll keep insisting it HAS to be there because it wouldn’t make sense or it not to be. …EXACTLY.

Just to point out, you did say this, but not all in one place. You said early on that the cuts amounted to $1 trillion. Later you stated the cuts were spread over 10 years.

The government and political parties often do this when talking budgets, either to emphasize tax cuts or the scare with budget increases. I have gotten used to it, and even come to expect it.

The bits in italics with an asterisk were added in edits.

To be fair, it wasn’t that the CBO lied, it was just because the reports were long and complicated and I skimmed over them, essentially missing the details.

Oh, and for clarity, the cuts aren’t “spread out” over 10 years. They actually happen in the next 6 months. The $1.2 Trillion comes from savings compounded over a ten year period assuming the cuts stick. Does that make sense?

Thank you for this post. It’s impossible for me to keep up with every detail of news I’d like and this had gotten by me and I was having a difficult time catching up. You laid it all out and made it very easy to understand!

The sequester will not, as you claim, cut 25% “from nearly everything the government does.” According to the CBO, the total reduction in the growth of federal spending for this year is less than $90 billion, not $900 billion as depicted in your two-second chart. $90 billion is far less than 10% of $3.9 trillion. It is, in fact, right around 2%, which means the chart you deride is far more accurate than the one you created. (BTW, the CBO says this year’s spending reductions will be only around 45 billion because much of the reduction in spending will actually occur next year.)

The people downplaying the impact of the sequester are no more guilty of hyperbole that the chicken littles out there telling us the sky is falling. The fact is the sequester cuts nothing except the rate of growth. According to some, if the sequester “cuts” are allowed to remain in place America will become an economic hellscape in which this year’s federal budget of $3.6 trillion will only be slightly more than last year’s $3.5 trillion. How will we ever live with such a small increase?

I appreciate that some will be hurt by these reductions in the growth of federal spending, but there is good reason to be concerned about that rate of growth. The size of the federal budget has nearly doubled since FY2000, and many Americans are wondering why they haven’t seen a commensurate increase in the amount or quality of service they receive. Do you think the amount or quality of service you receive from the federal government has doubled since FY2000?

“Do you think the amount or quality of service you receive from the federal government has doubled since FY2000?”

Me personally? No. But we have a LOT more people on food stamps, medicare, disability, unemployment, Social Security (both survival and retirement)… the vast majority of the deficit increase has been these non-discretionary elements.

When you cut these benefits, people cannot pay for houses and cars (big economic drivers). When you cut mental health services, you cut nursing jobs, whose salaries pay for iPhones and furniture. Firing teachers has direct impacts on students of course, but it also dings the bottom lines of clothing manufacturers and restaurant owners and toy manufacturers.

Alternatively: what’s all the waste you would want to cut? What are we squandering money on that we can do without?

And there is no reason to be concerned about the budget deficit. So it’s doubled–so what? It means literally nothing. The worst it could possibly cause would be some mild inflation–IF we were at full employment, which we aren’t even close to, and which could easily be corrected by raising taxes a bit if necessary once the economy has recovered. Also relevant: http://bilbo.economicoutlook.net/blog/?p=3773 — “Zimbabwe for Hyperventilators”

“The size of the federal budget has nearly doubled since FY2000, and many Americans are wondering why they haven’t seen a commensurate increase in the amount or quality of service they receive. ”

And the size of the federal budget more than doubled between FY1990 and FY2000. And more than doubled between FY1980 and FY1990. And what are crude oil prices these days? Triple what they were since FY2000?

Call me a dreamer, if you will, but I’m not only not awake nights wondering why I haven’t seen a commensurate increase in the quality of a barrel of oil today, but I’m confident almost no Americans are raising a hullabaloo about federal debt because their tax dollar doesn’t buy as much in the way of “service” as it did in 2000.

It’s interesting you chose oil prices as a point of comparison. The federal government doesn’t use energy when calculating CPI because energy costs are so volatile. Be that as it may, according to BLS statistics, the CPI has increased less than 30% since FY 2000, while federal spending has gone from $1.8 trillion in FY 2000 to $3.9 trillion in FY 2013. So when I said federal spending “nearly doubled” I was speaking in inflation-adjusted dollars.

BTW, oil has increased from around $35/bbl to just under $100/bbl in that same time frame.

A) And it’s interesting you’d raise the specter of “volatility” in oil prices because it’s a signal to explain price changes in the short term, one which nobody who’s actually trying to discuss these issues honestly would invoke to hand-wave the difference between oil prices ten years ago and oil prices today.

B) Furthermore, it’s interesting you’d raise the growth in the CPI for comparison. If CPI has increased “less than 30% since FY 2000 while fed spending has gone from $1.8 to $3.9 trillion today” (conceding to your figures here, for the sake of argument) that’s a powerful signal that the size of the debt Is Not A Problem!!! Generally speaking, the CHIEF reason one would worry about the size of fed deficit spending is that it is causing troublesome inflation. Obviously….that isn’t happening. Not in the CPI. Not only isn’t it happening now, there’s no HINT of it even in the distant horizon. So what explains the mass hysteria over the size of the federal debt?

Seriously! What makes USA govt debt good? Bad? In your own words, when is it good? When is it bad?

You brought up the increase in the price of oil compared to the increase in government spending. I offered a reason why such a comparison isn’t germane.

My initial point in this discussion was about the growth of government spending, not the size of the deficit (although there are many reasons to be concerned about the deficit as well). And if you are going to comment about them, please take the to check my figures rather than “concede” them to me; I wouldn’t want anyone to infer I was making something up.

Is my assessment that federal spending has nearly doubled since FY2000 accurate?

@ Mark Sletten / March 11, 2013, 10:01 am

I compared the increase in the price of oil because, unlike what accounts for the rise or fall in federal government expenditures over time, 1 barrel of oil in 2000 is IDENTICAL to a barrel of oil in 2013 in everything but its price tag. Americans may care very much about the cost of both, but it’s the price tag that’s bothering them, and any “commensurate increase in quality” is the furthest thing from their minds. The doubling of fed spending is not a problem! It’s doubled, tripled, or quadrupled each decade for the past 70 plus years, except once-under Clinton. (And that didn’t bode well, as it turns out, given the corresponding escalation in household debt, a tech bubble et al.)

PS Your numbers seem fine. I wasn’t implying your numbers weren’t accurate but that they show that the size of the deficit is Not A Problem. Lemme guess. You’re another who is supportive of the Budget Control Act because it shrinks government, amirite? And you don’t like government. That’s not what the American people are being told, though, is it? The Budget Control Act was about Deficit Reduction, not Size of Government Reduction. Americans don’t care how big government is, so they’re being sold a line of bullshit about the debt being too big and how we need to “tighten our belts” before we become “another Greece” or our Chinese bankers foreclose on us and other such nonsense.

Yes. Making a mistake and editng it quickly and clearly is obviously being “guilty of hyperbole.”

Also, in terms of the size of the budget over time, Business Insider has a bunch of graphs showing the budget as a percentage of GDP: http://www.businessinsider.com/federal-government-budget-overview-2011-1?op=1

You’ll see it has remained quite steady at around 20% of GDP over the last 50 years.

You accused the makers of the top chart of being misleading, yet when you “corrected” your article you left your very misleading chart in place. Yes, you made an entry below acknowledging the sequester would occur over 10 years instead of one, but you did not indicate in the article that your chart is wrong. Further, your article includes the following statement : “The question is really over whether a mandatory 25% cut to literally every single thing the government does is really the best way to be reducing our deficit.” (Emphasis added.) This implies the sequester will cut 25% from the budget across the board. In the text above that, however, you say the sequester will not cut mandatory spending programs. Which is it?

Further, the CBO says the sequester will cut less than $90 billion from this year’s TOTAL budget of $3.9 trillion. $90 billion is a bit more than 2% of 3.9 trillion. The top chart, which you say is wrong by “a lot”–seems to reflect this accounting accurately. I get that you disagree with depicting federal spending without comparing it to GDP, but you said “that little red bit on the chart looks like about 2% so they are off by … a lot. Whoever made this chart was either intentionally attempting to mislead or is really bad at math.” Given $90 billion really IS around 2% of $3.9 trillion, why is this chart wrong (notwithstanding your beef with the lack of comparison with GDP)?

Finally, you do not acknowledge the sequester is not a cut, it is a reduction in projected spending growth, and a small one at that. Without the sequester the federal government had planned on spending $47 trillion over the next ten years. The sequester reduces that by $1.2 trillion, or 2.5%. So not only will the sequester not reduce spending, it will not reduce the deficit. Like spending, the sequester will only reduce the expected growth of the deficit.

Like I said earlier, the debate is extremely frustrating.to me–as inevitably happens, you’ve armed this rejoinder with economic red herrings, false equivalents, and non sequiturs–and they function much like land mines, kaboom and everyone scurries back to safety and returns fire with their respective Know Notsoverymuch catch phrases.

This “it is not a cut, it is a reduction in projected spending growth” is economic nonsense-speak. Do you understand how many ideologically based “givens” are required to underpin that statement for it to make it the least bit relevant to this issue?

Instead of typing a list of logical fallacies, why not respond to my points and tell me where I’m wrong. Clearly I do not understand why the writer accuses the chart maker of attempting to mislead or not understanding math, so educate me.

Will the sequester cut 25% from literally everything the government does?

Is $90 billion around 2 percent of $3.9 trillion?

Forget ideology, just stick to layman’s terms (that’s what this post was supposed to do in the first place). If a person expects a 10% raise next year but only gets 5% do they say they got a pay cut?

@ Mark Sletten / March 11, 2013, 10:08 am

Those figures were corrected before you or I commented on them.

The chart IS misleading because the cuts don’t apply to the $3.9 trillion – they apply to the discretionary side of the budget only (approx 31% of it, or $1.2 trillion). So the cuts (where they will be felt) average about 10% of the 1.2 trillion every year for 10 years. And the majority of it ARE cuts, not a “less than expected increase”. For example, defense spending (which is the most hit) was already reduced from the year before (defense spending peaked in 2010).

Thanks for this post. Is the $3.9 Trillion figure cited above just for discretionary spending? I assume so but, as noted, lots of people are throwing around lots of numbers. Also I thought that the cuts were supposed to be equally divided between domestic and defense spending, but its unclear to me if that’s in total dollars or in percentages. Do you know? Thanks again for trying to bring some clarity to this mess.

Yes, $3.9 Trillion is just for discretionary spending. The sequester savings are divided up equally between Defense and Domestic spending, with $500 Billion for each. I’m not 100% sure whether the amount of money being currently cut from each is equal because it’s possible that they have different projected growth rates, but it should be fairly similar. Because Defense programs make up less than half the budget, they are being hit the hardest by the sequester.

No, that’s wrong. $3.9 trillion is the estimated FY2013 federal budget–ALL spending. Total discretionary spending for FY2013 is projected to be approximately $1.5 trillion.

http://en.wikipedia.org/wiki/2013_United_States_federal_budget#Total_revenues_and_spending

You do a great job of showing how the sequester will affect common people. But I’m afraid you’re falling into exactly the same false-framing trap that most Americans do — accepting the notion that shrinking the federal budget deficit is in any way important.

Money is something the government creates. We are set up to allow the government to print Treasury bonds but not dollar bills, mainly because the bonds give free money to rich people (in the form of interest payments). But we could just as easily allow the government to print dollars directly if it needs to spend more, and then poof! no more debt. No “burden on future generations,” no nonsense about becoming Greece (which can’t print Euros the way we do print dollars when we issue T-bills). Deficits and the federal debt, these are just artifacts of accounting. They never have to be repaid; and even if they were, the government presses contain infinity dollars to pay them with.

As skeptics, we should turn a skeptical eye not just to the heavens, but also our terrestrial dogmas. We should ask questions about *why* a specific deficit-to-GDP ratio is considered problematic (Japan’s has been way higher than ours for over a decade and they’re fine); about *why* the deficit is considered a problem now when, with the exception of a few years here or there, the government has been awash in nothing but red ink for literally two and a half centuries; about *why* the policy prescriptions always center around taking another pound of flesh from the middle class and below. Why should we worry about the debt we “pass down to our children” when every generation before ours has passed one down to us? WWII debt didn’t sandbag the ’50s and ’60s, nor Reagan’s debts the ’90s; why are we told that this time it really matters?

Deficit hawks are the woo-doctors of the body politic–pushing unproven, even disproven, prescriptions which can only cause harm.

For those interested in reality-based economics skeptical of the mainstream, check out Stephanie Kelton and Warren Mosler of U-Missouri Kansas City (moslereconomics.com/ and neweconomicperspectives.org/category/stephanie-kelton) and Bill Mitchell & Steve Keen, two Australian academic economists with a lot to say on the subject, as well as a host of other less famous contributors.

True, true, everything you’ve said is true.

One could also add more well-known authorities who’ve said this, including Paul Krugman and Ben Bernanke. And some of the more honest conservatives, who will admit they are not worried one bit about the size of this deficit. They do not like the power of our federal government, full stop, and intend to shrink its size via starvation diet.

This post wasn’t about whether or not the deficit is bad for the economy. My own opinion more closely aligned with the idea that the deficit is probably not as big a deal as we tend to think and that the time to try to lower it is most certainly not while we are in a fragile economic recovery. That’s certainly not a consensus opinion among economists though and there is quite a lot of debate. I’m also not a macroeconomist so my opinion is merely from reading the writings of economists much smarter than myself and thinking “hey, that makes sense.” I don’t think I really have the expertise to make a clear and public stance especially when I’m not 100% convinced myself.

Sayinig that, this post wasn’t about that issue. My purpose of the “deficit is bad” part was to convince people who do think we should be reducing the deficit that the sequester is not the most efficient way to do that. In other words, assuming Congress is going to reduce the deficit no matter what and the generally public opinion that the deficit should be reduced, what is the best way to go about doing that? I probably should have made that a bit clearer and not perpetuated the “deficit is always bad” idea, but I was attempting to focus on simplicity.

These sequester discussions are tremendously frustrating because the deficit is not so bad as all that. It’s just fine. The panic over the deficit makes about as much sense as the panic over Y2K and the panic over the Hadron Collider.